Interchange fees: What are they, and how do they work?

Businesses must pay an interchange fee every time customers use a card at checkout. It amounts to around 70% of the transaction commission and can vary significantly depending on various factors.

This article will explain these factors, the tariffs in different countries, and how they affect your business.

What are interchange fees?

Interchange fees are the charges a merchant’s bank (acquiring bank) pays to the cardholder’s bank (issuing bank) every time a credit or debit card transaction is processed. These fees help cover the costs of fraud protection, infrastructure, and other risks associated with payment processing.

Simply put, when a payer uses a card to purchase, your business doesn’t receive the total amount. A small percentage—typically between 1% and 3%—is deducted and sent to the payer’s bank.

Besides an interchange fee, card processing includes:

- Acquirer markup – the fee the merchant’s bank charges for acquiring funds from the payer.

- Card scheme fees – the charges of card networks like Visa or Mastercard for supporting transactions.

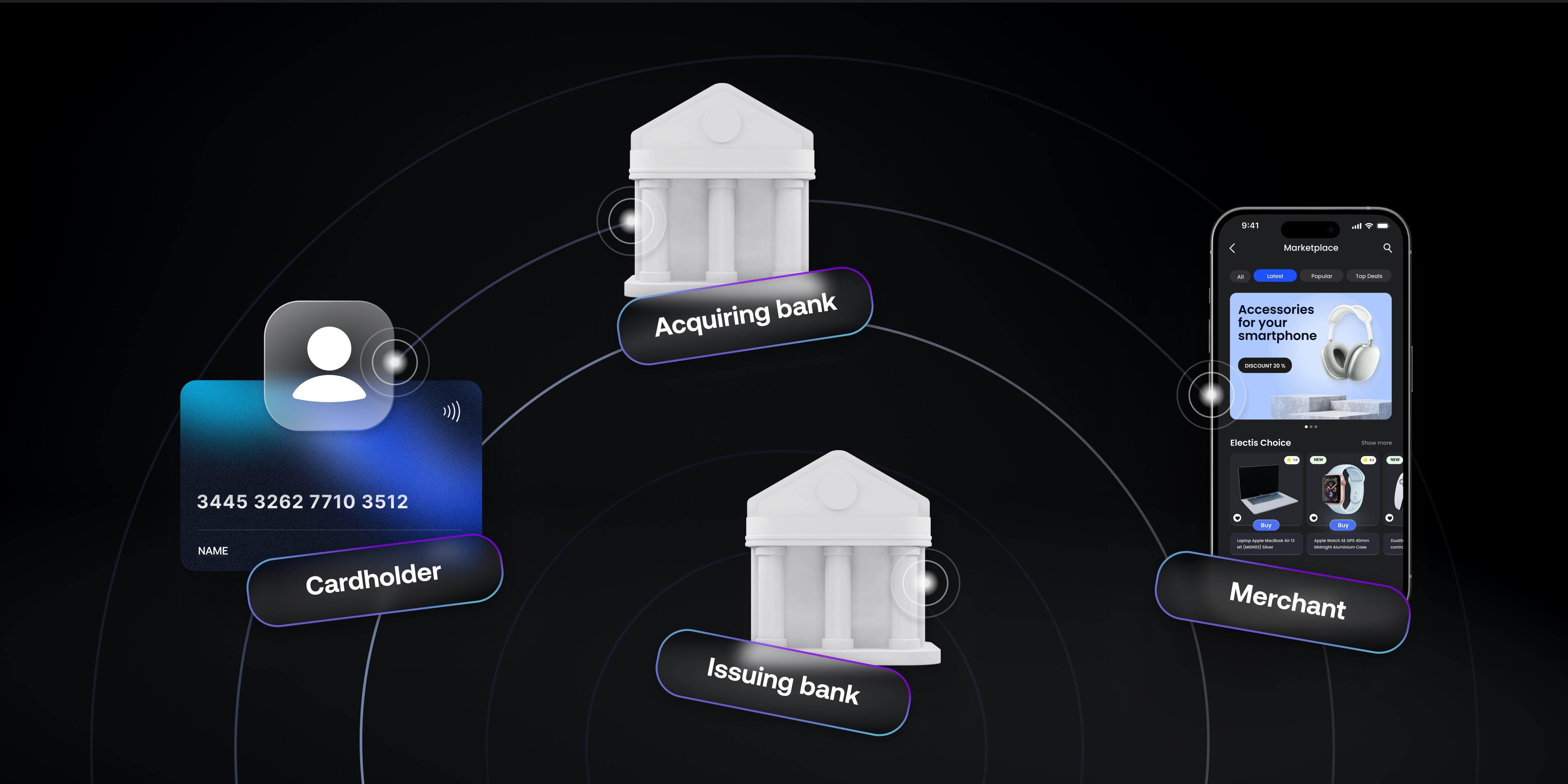

How interchange fees work

Let’s break down a typical card transaction to understand how interchange fees are collected.

Key parties:

- Cardholder – the customer purchasing with a debit or credit card.

- Merchant – your business accepting the card for payment.

- Acquiring bank – your bank that processes the payment.

- Issuing bank – the payer’s bank that issued the debit or credit card.

- Card network – companies like Visa and Mastercard facilitate transactions and set interchange fee rates.

The transaction process:

- Transaction initiation: The cardholder makes a payment using a credit or debit card. You submit payment information to the acquiring bank.

- Authorisation: The acquiring bank forwards the request to the card network, which passes it to the issuing bank.

- Approval: The issuing bank checks the cardholder’s account for funds or available credit and sends the authorisation back to the acquiring bank and your business.

- Settlement: The card network consolidates and calculates the transactions for the day. The issuing bank transfers the payment to the acquiring bank minus the interchange fee. The acquiring bank also takes its fee and deposits the payment to your business account.

Though businesses initially cover these fees, they are often passed on to consumers indirectly through slightly higher prices.

How interchange fees are calculated

Interchange fees are determined by the card networks – Visa, Mastercard – can vary depending on the following factors:

- Card type: Credit cards generally have higher interchange fees than debit cards due to greater risk. Same with rewards cards because banks must make up for the cost of perks like cashback or travel points.

- Transaction type: In-store card transactions usually have lower fees than online transactions, which are riskier due to fraud potential.

- Merchant category: Different industries face different fee structures. For example, retail businesses may have lower fees than travel or hospitality sectors, which are considered higher-risk.

- Country: Some countries have regulatory caps on interchange fees, while others do not.

- Transaction amount: Larger transactions generally mean higher fees for merchants due to the percentage-based structure of interchange fees.

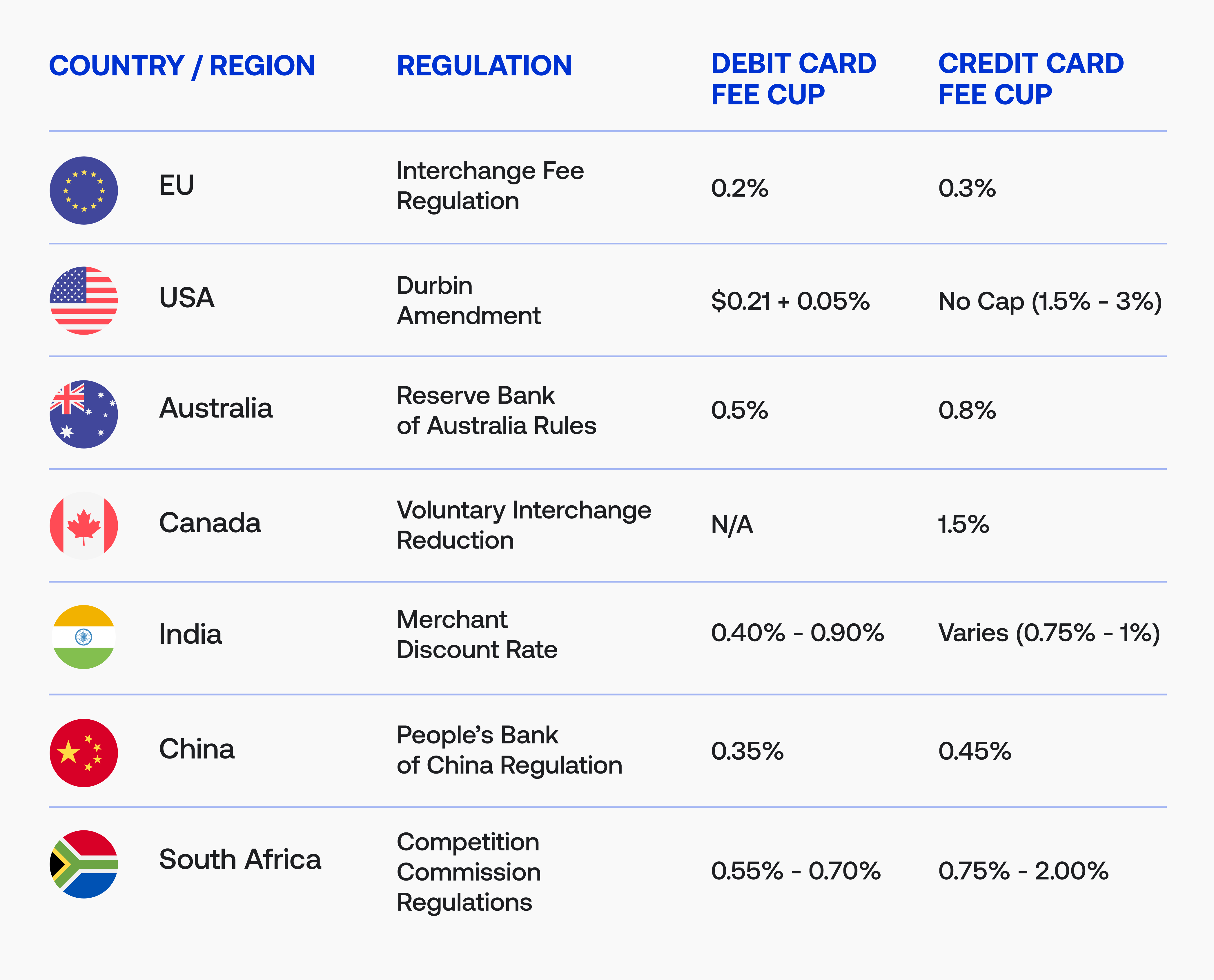

Interchange fees in different countries

Some countries and regions have implemented regulations to control interchange fees. These regulations aim to protect businesses from overcharges and promote fair competition.

Interchange pricing models

Interchange fees aren’t one-size-fits-all – they come in different pricing models that affect how much a merchant pays for each transaction. Knowing these models can help you choose the best option for your needs:

Blended pricing model

In the blended pricing model, you pay a single, flat rate for each transaction. This rate includes the interchange fee, card scheme fees, and the acquiring bank’s markup, all wrapped up into one easy-to-understand number.

- Pros: It’s simple and predictable. You know precisely what you’ll be charged when a customer pays with a card.

- Cons: The fee breakdown is hidden, meaning your business might pay more than necessary for certain transactions.

- For whom: Smaller businesses that want straightforward pricing without worrying about the complexity of individual fees.

Interchange plus pricing model

The interchange plus model gives you more transparency. Here, the card networks charge the actual interchange fee, and then the acquiring bank adds a fixed markup on top.

- Pros: You can see the exact interchange fee and the bank’s markup, making it transparent and often cheaper, especially for high-volume businesses.

- Cons: Fees can vary by transaction, making it harder to predict costs.

- For whom: Businesses with higher transaction volumes or those who want transparency and control over their costs.

Tiered pricing model

With tiered pricing, transactions are grouped into different categories or tiers based on risk or type (e.g., card-present, card-not-present, rewards cards). Each tier has a different rate.

- Pros: Depending on the tier, you might get lower rates on certain transactions.

- Cons: It can be confusing since you won’t always know why a transaction is assigned a particular tier and rate.

- For whom: Businesses processing different types of transactions and wanting flexibility in rates.

Learn about the full scope of fintech fees.

How you can pay less interchange fees

Reducing interchange fees can save your business money and improve profitability. Here are some standard practices:

- Increase prices: Some businesses increase prices to offset the cost of interchange fees. While this helps keep the profits, it can lead to loss of customers in competitive markets. They will simply choose cheaper alternatives.

- Negotiate with your provider: If your business handles high transaction volumes, negotiate with your payment processor for better rates. Larger enterprises often get discounts based on volume.

- Encourage low-fee payment methods: Promote cash-based, debit card, or mobile wallet payments, which usually have lower fees than credit cards, especially high-reward ones.

- Set minimum purchase amounts: Implement a minimum purchase requirement for card transactions to avoid paying high fees on small sales.

- Follow card network best practices: Card networks like Visa and Mastercard offer guidelines on secure card processing. Following these can lower your risk profile and help you qualify for lower rates.

In the quest to reduce the amount of commissions, it’s essential not to forget how it can affect your customers and their experience with your product. You can save money on commissions but lose a customer, reducing revenue in the long run.

The goal is to balance saving on costs and maintaining a smooth, convenient payment process. Payop can help you with it. Contact our team at sales@payop.com to get an individual consultation.