What is a chargeback?

Table of content:

Every business looks for opportunities to minimize their risks and to penetrate new markets. And it is especially true for the B2C segment, where the legislative branch implements strict frames, trying to protect customers’ rights. However, some factors cannot be prevented, and chargebacks are one of them.

For those, who are familiar with the financial area, the chargeback process seems clear, but for others, it can be tough to realize and to put it into practice.

Any customer has the right to refund money for a paid purchase. In particular cases, if the merchant refuses to pay the money back, the customer can appeal to their issuing bank. Having received the complaint, the bank, for its part, starts to interact with this case and checking the transaction – this is called a chargeback procedure.

By simple words, a chargeback – is a process of appealing an online credit card transaction, initiated by the cardholder. Frequently, those, who initiate a chargeback procedure, are unsatisfied customers, but in some cases, banks can be initiators. Such cases include operations that are made with non-existent credit cards.

A procedure is quite complicated and customers are not always won. The purpose of a chargeback is to negligible the number of fraudulent transactions and to solve issues between customers and online merchants.

When customers can initiate a chargeback?

This procedure can be initiated in different cases. As we mentioned above, the initiator can be both the client and the issuing bank.

In addition to cardholders, the chargeback function is also available for owners of electronic wallets.

The most common causes of chargebacks:

Credit card fraud

This type of fraud occurs when a person who is neither a cardholder nor a merchant makes an online transaction. Fraudsters use various methods to obtain customer bank data or credit card information for further use.

The consumer, having discovered the funds withdrawn, can report the issuing bank. The bank will verify the transaction, and in case of confirmation of illegal debit, it will return the money.

The most common examples of credit card fraud:

-

Inattention. Sometimes customers leave a bank card in the store where it can be picked and used or further purchases by unauthorized persons.

-

If the fraudster knows your bank number, he can transfer money to his personal bank account.

-

Your card details can be stolen by making a photo of it.

Merchant mistake

When submitting a chargeback, cardholders believe that the merchant made a mistake, but merchants often disagree with this decision.

But even if the merchant made a mistake – this is not fraud and usually, such situations are resolved with the merchants directly, without involving the bank.

The list of a merchant mistake reasons:

-

The customer received non-working device due to damage during transportation.

-

Inflated expectations from a product or service.

-

A merchant could indicate the overestimated characteristics of the product on the site.

-

The merchant refuses to accept the goods back because the return period has expired.

-

When paying for subscription services, the client was not informed about the end of the trial period.

-

A customer forgot to cancel the automatic debit.

Merchant Fraud

This type of fraud is a deliberately illegitimate action of a merchant who uses the ignorance of customers.

Merchant fraud is difficult to detect and track, because of the ecosystem of online payments. Nevertheless, detecting and preventing this kind of fraud can save a much more money related to chargeback complaints, commissions, and fines.

As a result, the buyer indirectly is an accomplice of this kind of fraud, which may affect the right to win a chargeback case or impose fines.

Consider the most common types of merchant fraud:

-

The merchant did not deliver the goods or did not provide the paid service.

-

A fake product is issued as the original.

Not providing the promised product or service, deliberately setting a higher price for the client than indicated on the website, or brazenly deceiving, unscrupulous merchants may very likely face a high percentage of chargebacks and go bankrupt.

Friendly fraud

Friendly fraud is a fairly broad category that has various methods of chargeback claims.

Most often, this term refers to cases when the chargeback was initiated by mistake, or intentionally, to obtain benefits.

But there are some other cases:

-

The cardholder could transfer his data to a relative or acquaintance who made the purchase. If the amount was too large, then the client may demand a refund.

-

When making a purchase, funds may not be debited but “withheld” until the goods arrive. The client can forget about it and initiate a chargeback at the issuing bank.

-

A fraudster makes a purchase on the site. After that, they pretend that they regret the purchase and ask for a refund. Often, they indicate that they have not received the goods. Thus, winning a chargeback, the fraudster receives both money and goods.

-

After purchasing the goods, the customer declares that he was defective. The issuing bank makes a chargeback and returns the money.

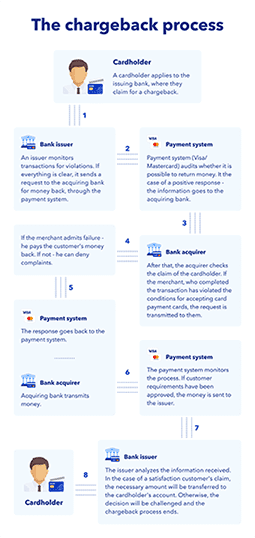

A chargeback claim procedure

The whole procedure is quite long and takes several months, in some cases up to six months. This time is necessary for thorough verification of the transaction to exclude any fraud attempts.

Consider the standard chargeback procedure for Visa and Mastercard bank cards.

-

A cardholder applies to the issuing bank, where they claim for a chargeback.

-

An issuer monitors transactions for violations. If everything is clear, it sends a request to the acquiring bank for money back, through the payment system.

-

Payment system (Visa/Mastercard) audits whether it is possible to refund money. It the case of a positive response – the information goes to the acquiring bank.

-

After that, the acquirer checks the claim of the cardholder. If the merchant, who completed the transaction has violated the conditions for accepting card payment cards, the request is transmitted to them.

-

If the merchant admits failure – he pays the customer’s money back. If not – in some particular cases, he can deny complaints.

-

The response goes back to the payment system; Acquiring bank transmits money.

-

The payment system monitors the process. If customer requirements have been approved, the money is sent to the issuer.

-

The issuer analyzes the information received. In the case of a satisfaction customer’s claim, the necessary amount will be transferred to the cardholder’s account and the chargeback process ends. Otherwise, the decision can be challenged.

How to avoid chargebacks?

In order not to become a victim of numerous financial sanctions, merchants should avoid chargebacks. And you, as a business owner, should take necessary steps:

3D-secure

3D-Secure technology is a service that ensures the security of online payments. The service allows making an additional authentication of the cardholder when making payments on the Internet, on websites, that support this technology. All modern payment providers work with such technology.

When one makes card payments, they receive an SMS with a password directly to your mobile phone. The specified password is sent immediately at the time of the transaction after entering the card details and can be used for confirmation only once.

Address Verification Service (AVS)

A system that allows you to check the cardholder’s billing address. By checking the billing address, the transaction will be associated with the physical address, and possible frauds are reduced. The system compares entered billing address with those, that are stored in the issuing bank.

There are two possible types of AVS codes: international and domestic. They depend on countries’ bank cards were issued. For online business owners, it is important to familiarize yourself with both of them.

Limitations

Fraudsters often try to make as many purchases as they can, when receiving card data. You can indicate the limited amount of transactions in your bank account. It is also possible to establish a maximum daily sum you can spend on online transactions.

Other helpful tips:

-

Merchants should have documents that confirm the service done. Often, the bank takes a consumer’s side simply because the merchant has not confirmed the fact of the delivery of the goods or services and can not provide any proof.

-

When a chargeback occurs, be sure to write a clear response and attach all available documentary evidence.

-

Describe all details in Terms and Conditions and Refund Policy.

-

If the decision was made in the customer’s favor, try to appeal it – there are examples of a positive court judgment.

The bottom line

The best way to prevent online fraud and avoid chargebacks is to have a reliable and secure payment gateway. PayOp payment platform offers not only a payment processing services “on a turn-key basis”, but also a modern fraud and chargeback prevention tools and techniques. Besides, PayOp support managers will take care of all chargeback cases that could emerge. Sign up a free merchant platform account and we will integrate a payment gateway on your website within one business day.