A guide to QR code payments

Did you know that by 2025, QR code payments are expected to hit $2.2 trillion? More and more buyers prefer this digital method to traditional credit or debit cards, especially in emerging markets like Brazil or China.

So, if you do or plan to do business there, make sure you introduce QR code payments into your checkout.

What are QR code payments?

QR codes, or Quick Response codes, are two-dimensional barcodes that store information that can be accessed using a smartphone or QR code reader.

As a payment method, they allow customers to make payments by scanning a code that contains all the necessary transaction details. QR code payments are popular because they are secure, fast, and easy to use, especially in digital environments.

Types of QR codes

- Static QR codes contain fixed payment information and remain the same for every transaction. These are useful for products or services with consistent pricing but require the customer to input the payment amount if it varies manually.

- Dynamic QR codes are generated in real-time for each transaction and include specific details such as the transaction amount and your business account information. These codes enhance security and user experience by eliminating the need for manual input.

How QR code payments work

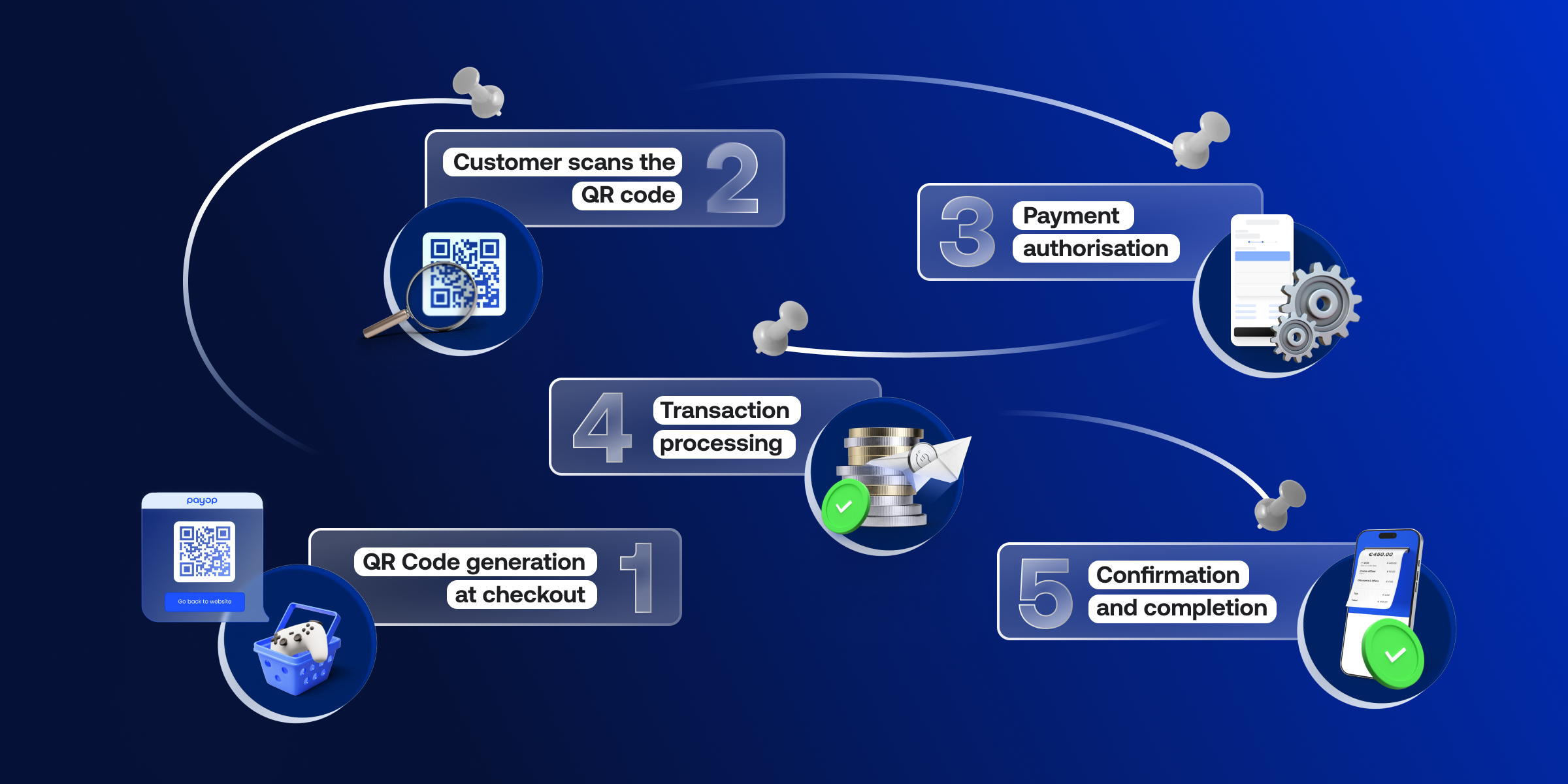

Here’s how QR code payments typically work in a digital setting:

- QR Code generation at checkout

When a customer selects a QR code as their payment method at checkout, your website or app generates a unique dynamic QR code. This QR code includes all transaction details like the payment amount, your business name, and account information. - Customer scans the QR code

The customer uses their smartphone to scan the QR code displayed on their screen. They can do it with a digital wallet that supports QR code payments, such as Google Pay, PayPal, or a regional service like Pix or Alipay. Scanning the code instantly sends the payment details to their app. - Payment authorisation

The customer sees all payment details in their app, including the amount and recipient. They check this information and authorise the payment through a PIN, fingerprint, or facial recognition, depending on the security features of their app. - Transaction processing

Once the customer authorises the payment, the transaction is processed. The funds are transferred from the customer’s account to your business account, typically within seconds. - Confirmation and completion

Both the customer and your business will receive confirmation that the payment has been made successfully. For the customer, Payop sends an email with the transaction status. Your business gets a notification in the Payop merchant dashboard.

Is it safe to use QR codes for payments?

The short answer is yes. QR codes are a secure payment method thanks to several robust security measures:

- Encryption of payment data: QR code payments use encryption to protect sensitive information. The data in a QR code is securely encoded, ensuring that unauthorised parties cannot intercept or change it during the transaction.

- Tokenization: Many QR code systems use tokenization, replacing sensitive payment information with a unique identifier (token) for each transaction. This ensures that even if the token is intercepted, it cannot be used to access the customer’s data.

- Dynamic nature of QR codes: Dynamic QR codes enhance security by being unique to each transaction. They expire after use, reducing the risk of fraud. A dynamic QR code cannot be reused, even if intercepted, making it more secure than static codes.

- Secure payment authorisation: Transactions require strong customer authentication (SCA), such as PIN codes, biometric verification, or two-factor authentication (2FA). These measures ensure that only authorised users can complete a payment.

Benefits of QR code payments for your business

Implementing QR code payment methods can provide several advantages:

- Enhanced security: Payments using QR codes are highly secure. The transaction details are encrypted and transmitted directly between the customer and the payment provider. This reduces the risk of fraud and unauthorised transactions.

- Optimised user experience: For customers, especially those shopping on mobile devices, QR code payments offer a quick and hassle-free way to complete purchases. This can reduce cart abandonment rates and improve overall customer satisfaction.

- Access to new markets: QR codes are widely used in emerging markets like Brazil or Kenya, where access to traditional payment methods is limited. So, by providing these methods at your checkout, you gain access to a broader audience of customers.

- Lower transaction costs: Unlike traditional payment methods, QR code payment methods often charge lower transaction fees. This can lead to cost savings for your business.

QR code payment methods at Payop

Currently, Payop supports two QR code payment solutions in Latin America:

MachPay

- Geography: MachPay is widely used across Chile and supports transactions in the Chilean Peso (CLP).

- Processing time: Transactions are typically handled within a few minutes.

- How it works: Customers simply need to scan the QR code displayed at checkout using their smartphone. They do not need to download a separate app, as MachPay integrates with popular local banking apps already installed on most users’ devices. After scanning the code, customers confirm the payment within their banking app, completing the transaction in just a few steps.

Pix

- Geography: Pix is Brazil’s most popular payment system, regulated by the Central Bank of Brazil. It supports transactions in the Brazilian Real (BRL).

- Processing time: Pix processes payments instantly, enabling real-time transactions.

- How it works: Pix requires customers to scan a QR code using their smartphone. Like MachPay, Pix integrates with Brazilian banking apps, so there is no need to download a separate app.

How to start using QR code payments

Starting to accept QR code payments is easy with Payop. By partnering with Payop, you gain access not just to QR code payment methods but to over 500 local and international payment solutions. This means you can cater to customers globally, offering them the convenience of paying with their preferred method.

Payop simplifies the integration process, allowing you to quickly add all methods of choice to your checkout within one contract. Beyond payment methods, you benefit from Payop’s robust security features and our dedicated support team, helping you manage payments effortlessly.

Contact us at sales@payop.com to learn more.