Advantages of Alternative Payment Methods

The world is steadily moving towards a cashless economy. The popularity of cashless payments is growing rapidly thanks to the development of modern technology. Without accepting card payments, online merchants can lose most of their customers and brick and mortar merchants lose about 30% of customers. Thus, businesses widely use card acquiring services.

A payment aggregator that provides card acquiring services processes debit and credit card transactions for online merchants. Now, millions of organizations, enterprises and stores use card acquiring, which enables them to accept payments on the website. By providing customers with an opportunity to pay for purchases with a card, the business receives many benefits. The client, in turn, receives a convenient payment method.

However, debit and credit cards are not the only way to pay for goods or services, and there are many alternative payment methods. Alternative payment methods give the ability to pay for goods and services in ways other than traditional bank cards. New technologies allow customers to use the capabilities of online banking, digital wallets, prepaid vouchers, bank transfers and even smartphones. This increases the popularity of these alternative methods.

Top 10 Payment Methods Around the World

| Asia Pacific | North America |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Europe | Latin America |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Why are alternative payment methods important?

Buyers make more than half of all online transactions using alternative payment methods. If you do not offer your customers an opportunity to choose payment methods, you are likely to lose sales. If you plan to do business abroad, it is worth exploring local payment methods because the growth of global e-commerce is largely due to international trade. Here are some advantages of alternative payment methods:

- accessible to more industries (fewer bans)

- increase the number of purchases on your website due to convenience and security

- more confidence for the buyer if the method is local (for example, POLi in Australia, Klarna and Giropay in Germany, VTC pay in Vietnam, and Oxxo in Mexico)

- often no chargebacks and refunds (for example AliPay, POLi, Trustpay, Webpay, Singpost)

- lower commission than card acquiring (for example QIWI eWallet, FPX Internet banking and Ideal Bank transfers)

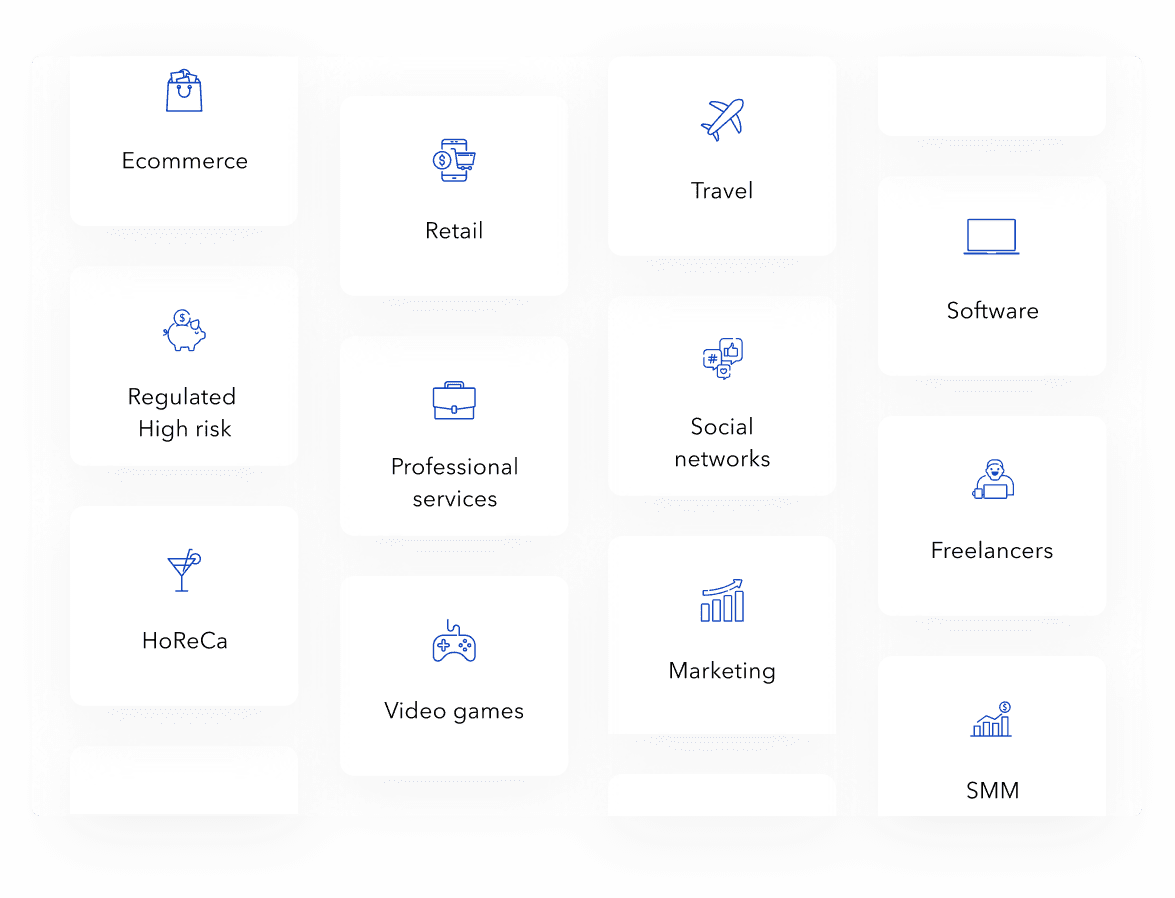

Alternative payment methods are best suited for the following market segments:

- Sellers of digital goods (small publishers, sellers of recharge vouchers)

- Video games

- Game marketplaces

- Freelancers, web studios, IT teams

- Professional services

- Traveling

- Ecommerce

- Gambling, betting

- Forex, binary options

- Dating websites

- SMM, likes

- Info business, training

What can PayOp offer you?

PayOp is an aggregator of payment methods for various types of businesses. It offers payment acceptance from over 150 countries, including EEA and CIS. You can provide your customers with over 300 ways to purchase online safely, securely, faster, and easier.

PayOp also makes it easy for merchants to conduct their business. Merchants can accept payments for online stores, websites, mobile applications, and services. You can choose which payment options are the best for you and your customers and enable them.

One-click payment option and mass payments are also available. Companies and entrepreneurs almost all over the world can use this payment platform. With PayOp, you will acquire security, an ability to work with high-risk industries, and low fees. Many payment tools and types of payments, withdrawal of the funds to any country using a preferred method and much more are also awaiting you.

You can find out more about the features of the PayOp payment system and how it can help you optimize your business processes on the official website – https://payop.com/