Payment gateways vs. Payment orchestration: What to choose?

In today’s digital commerce landscape, a seamless and secure payment experience is crucial for businesses of all sizes. Two key players in this arena are payment gateways and payment orchestration platforms. While both handle transactions, they serve distinct purposes and offer varying levels of functionality. Understanding the difference between these two technologies can empower businesses to choose the right solution for their needs.

What is a payment gateway?

Imagine a payment gateway as a secure bridge between your online store and the payment processing ecosystem. When customers enter their card details, the gateway encrypts the information and securely transmits it to the relevant payment processor. The processor then verifies the card details, checks for sufficient funds, and authorises the transaction. Finally, the gateway sends the approval or decline message back to you.

The key features of payment gateways include:

- Security: Gateways prioritise secure transaction processing by encrypting sensitive data and adhering to industry standards like PCI DSS.

- Payment processing: They facilitate communication with payment processors, ensuring smooth authorisation and settlement of transactions.

- Fraud prevention: Gateways offer essential fraud prevention tools to conduct checks before transactions.

- Limited payment options: Gateways typically support a set number of payment methods, often credit, debit cards and e-wallets.

Learn more about the payment gateway’s role in scaling your business.

What is a payment orchestration?

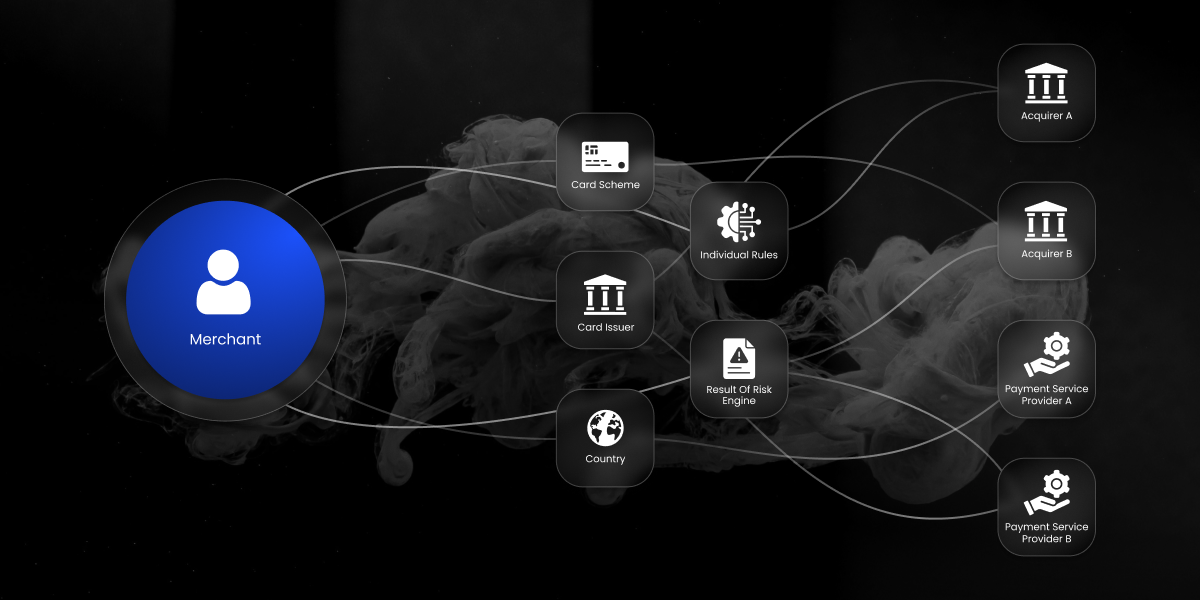

Think of a payment orchestration platform (POP) as a conductor overseeing a complex orchestra of payment options. It goes beyond the functionalities of a gateway by integrating various payment services under one umbrella and providing a unified interface for managing all transactions. It allows businesses to connect with multiple payment gateways, wallets, and other payment methods through a single integration point.

The key features of POPs include:

- Diverse payment methods: POPs integrate with a broader range of payment options, including digital wallets ( like Apple Pay, and PayPal), alternative payment methods (e.g., buy now, pay later), and international solutions.

- Optimised routing: POPs can intelligently route transactions to the most suitable gateway based on cost, risk profile, and geographical location. This can improve authorisation rates and reduce processing fees.

- Advanced analytics and reporting: POPs provide comprehensive reporting and analytics, allowing businesses to identify trends, optimise payment flows, and gain insights into customer preferences.

- Simplified integration: POPs offer a single API for integrating with multiple gateways, streamlining the development process and reducing technical complexity.

Payment gateway and payment orchestration differences & their meaning for your business

Understanding the distinction between payment gateways and payment orchestration platforms is crucial when crafting your company’s most effective payment processing strategy. These differences have a significant impact on your business operations, so let’s delve into seven key factors that can guide you towards the perfect fit:

- Do you value integration simplicity combined with the ability to meet complex payment tasks?

Payment gateways often require more technical expertise for coding and API integration. In contrast, payment orchestration platforms optimise the process, allowing a single API to connect you to many payment gateways and processors. This also allows to meet more complex payment challenges faced by businesses.

- What are your current and anticipated transaction volumes?

Payment gateways can be a suitable solution for businesses handling low to medium transaction volumes. However, if you anticipate significant growth, a payment orchestration platform provides the robust infrastructure to efficiently manage high volumes.

- Which payment options do you need to serve your target audience?

Payment gateways may offer a limited selection of methods, typically focusing on credit cards. On the other hand, payment orchestration platforms cater to a wider audience by supporting a diverse range of options, such as mobile wallets, e-wallets, and bank transfers.

- How will transaction costs affect your profit margins?

While both solutions charge transaction fees, payment gateways can be more expensive per transaction. Payment orchestration platforms might have a higher initial setup cost, but their real-time reporting and analytics empower you to gain control over transaction costs, potentially saving money in the long run.

- Does your business operate in a high-risk environment or experience high levels of payment declines?

Payment gateways offer basic security features like encryption and fraud detection. Payment orchestration platforms take it a step further with advanced tools like multifactor authentication, tokenization, and real-time fraud monitoring, significantly reducing the risk of fraudulent transactions and minimising false declines.

- Is flexibility and customisation important to you?

Payment gateways offer limited customisation and work with specific payment providers. Payment orchestration platforms empower you to personalise the first payment process, allowing you to choose from various providers and tailor transaction routing based on factors like cost, reliability, and availability.

- How dependent is your business on data, and do you experience seasonal fluctuations or changes in transaction volume?

Payment gateways offer basic reporting with limited analytics, which might not be sufficient for data-driven businesses or those experiencing fluctuating transaction volumes. Payment orchestration platforms excel in this area, providing advanced reporting and analytics to optimise payment processes and enhance your overall financial performance.

Get the advantages of a payment orchestration platform with Payop gateway

Already have a PSP but want to upgrade? Connect Payop and get the POP functionality.

Payop combines the simplicity and directness of a payment gateway with the versatile advantages of a full-scale payment orchestration platform. It presents your business with a unique solution that enhances your payment processing capabilities while remaining easy to integrate and manage. Operating as a payment gateway, Payop offers practically every feature of traditional payment orchestration platforms:

- Multiple payment method integration: Payop goes beyond just credit cards, offering integrations with over 500 popular methods, including digital wallets and alternative payment solutions.

- Smart routing: Payop leverages its connections with various processors to optimise transaction routing for approval rates and cost efficiency.

- Enhanced analytics: Payop provides valuable insights into your payment performance, with its advanced reporting tool. It helps you identify trends and make data-driven decisions.

- Simplified integration: Payop offers various integration options: API, technical integrators and plugins – that allow you to connect all payment methods simultaneously and within one contract.

By integrating Payop, you can benefit from the robust functionality of the payment orchestration platform without rebuilding your existing payment infrastructure. It allows for operational efficiency and cost savings combined with enhanced customer experience at checkout, higher transaction success rates and a wider choice of payment options.

Whether you want to expand globally or optimise your existing operations, Payop offers a powerful, scalable solution bridging the gap between traditional payment gateways and complex payment orchestration platforms.

Contact Payop team at [email protected] to learn more and get individual consultation.