Automated payments and how your business can benefit from them

In today’s fast-paced business environment, efficiency is key. Automating repetitive tasks can free up valuable time and resources, allowing you to focus on core growth strategies. Automated payments let you do just that by enabling you to solve the issue of regular transactions once and not waste any more time on them.

This article explores what automated payments are, how they function, and how they can enhance your business operations.

What is an automated payment system?

Automated payments are the technology that allows businesses to automatically process financial transactions without manual intervention. This can include recurring bill payments, payroll disbursements, supplier payments, and customer transactions.

Such systems are integrated with a business’s financial infrastructure, facilitating smooth, timely, and accurate payment processing through various methods, including bank transfers, credit card transactions, digital wallets, and electronic funds transfers (ETFs).

How do automated payments work?

To understand the full potential of automated payments, it’s essential to know how they operate. So let’s take a look at the workflow of automated withdrawal payments you can make with Payop:

-

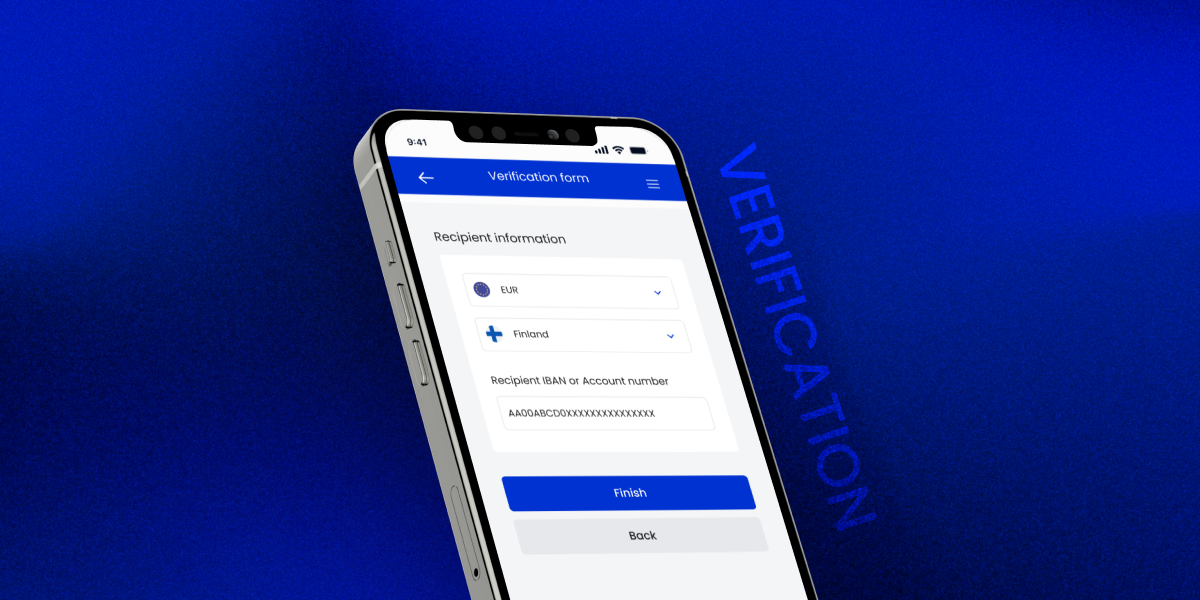

Integration and verification

As soon as you connect the Payop platform to your website, you can start setting up automatic withdrawals to your verified accounts. The first step is to submit for a check your recipients’ data, such as bank details, the address of the business incorporation, and a document confirming account ownership.

-

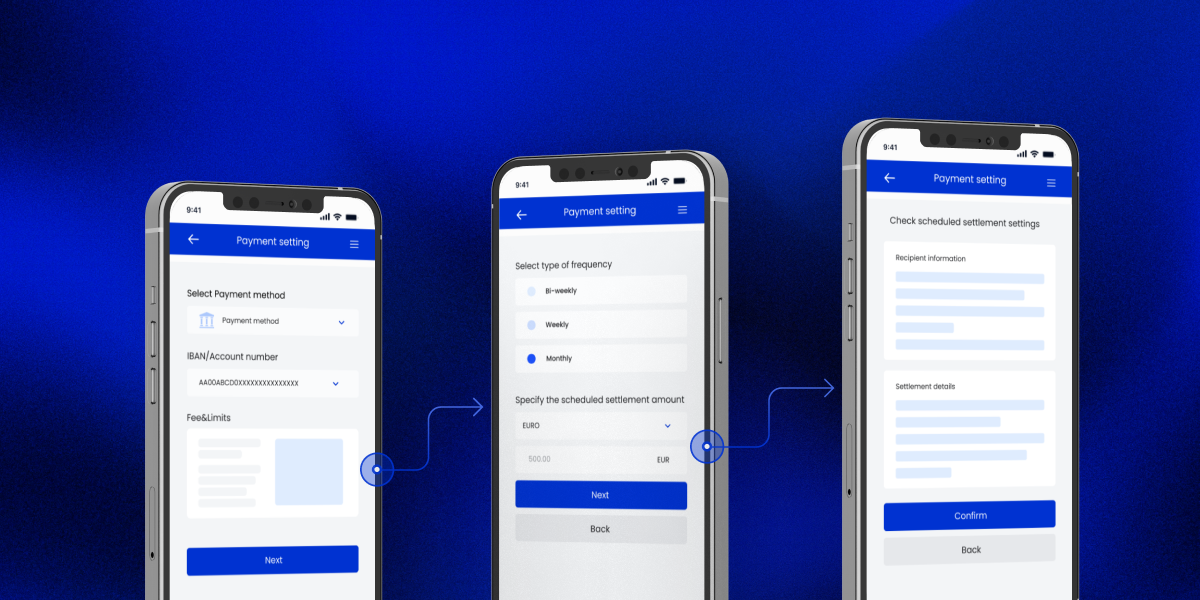

Payment setup and scheduling

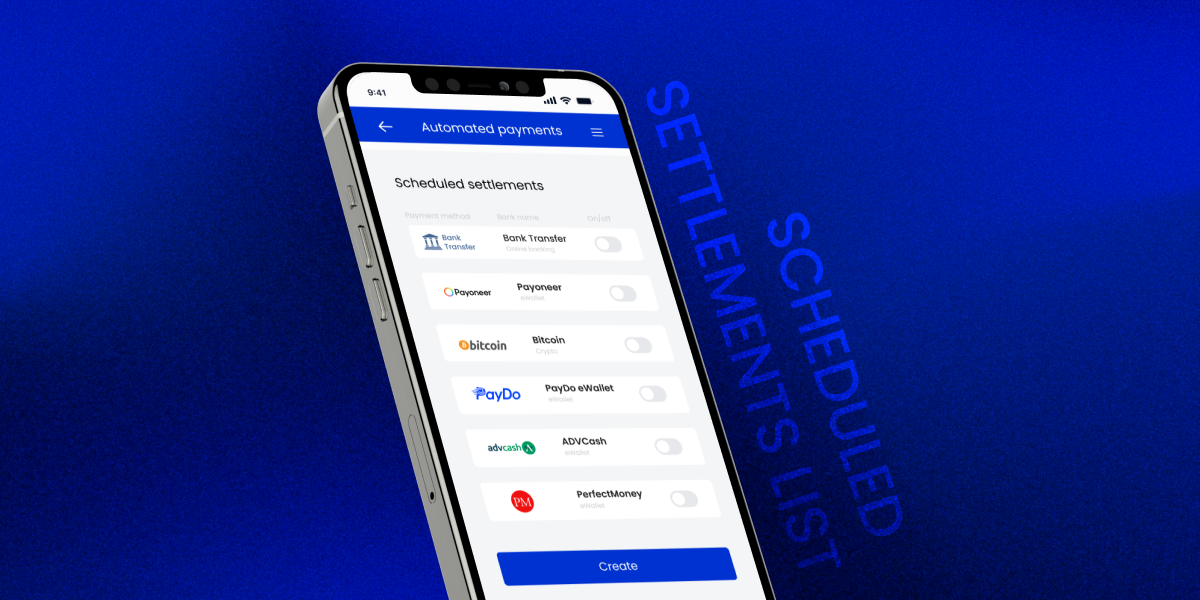

Once the accounts are verified, you can configure our system to make certain automated payments. You schedule settlements by setting the amount, frequency and payment method and selecting one of the verified recipients.

-

Transaction initiation

When a payment is due, the automated system initiates the transaction based on your pre-defined rules and schedules. This initiation involves sending a payment request to the bank or payment processor, which then processes the payment from your business account to the recipient’s.

You can then easily control scheduled withdrawals by temporarily switching them off or deleting them.

-

Verification and security checks

Before finalising the transaction, the automated system performs several verification and security checks. These checks ensure that the payment details are correct and that the transaction complies with security protocols. This might include checking the balance for sufficient funds and ensuring the transaction meets compliance requirements.

-

Processing and settlement

After verification, our system will process the payment. This step involves transferring the funds from your business account to the recipient’s account.

Depending on the payment method, this procedure can take from a few seconds to a few days.

-

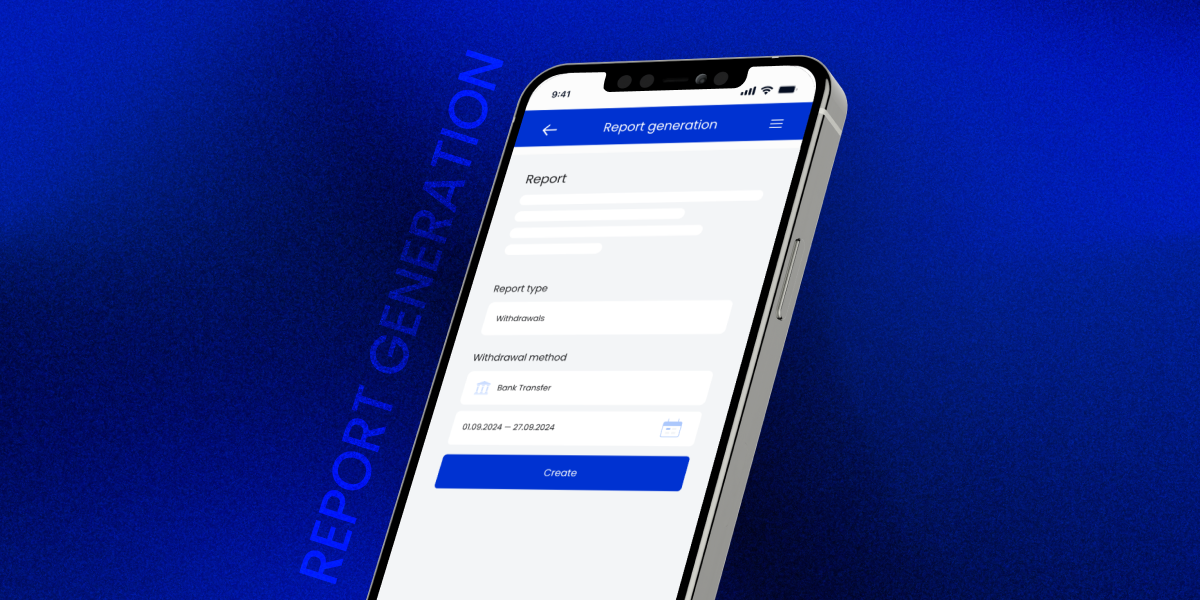

Notification and record keeping

Once the payment is complete, you will receive a notification. Our automated system will update the transaction records in your payment account, providing a record for future reference. Our reporting tool also allows you to get detailed information about all your withdrawal operations, providing you with real-time insights.

-

Continuous monitoring and optimisation

Payop’s automated payment system is equipped with monitoring tools to track the status and efficiency of transactions. These tools help identify any issues, such as failed transactions or discrepancies, so they can be resolved quickly.

Benefits of automated payments

Automated payments are not just about efficiency. They bring with them a host of benefits that can significantly boost your business. Here’s how embracing automation can transform your finances and empower you to focus on growing your business:

- Enhanced operational efficiency: Manual payment processing is time-consuming and prone to errors. It involves multiple steps, from data entry to authorisation, and requires significant human oversight. Automated payments eliminate these processes, freeing up valuable resources.

- Improved cash flow management: Automated payments provide better control over cash flow by ensuring timely payments and receipts. With Payop’s real-time monitoring and reporting, your business gets access to up-to-date financial data, which allows for better financial planning and decision-making.

- Reduced errors: Human errors in payment processing can lead to costly mistakes. Automated systems are designed to minimise these errors by ensuring transactions are processed correctly every time.

- Enhanced security: Payop’s automated payment system comes with advanced security features, including encryption, tokenization, and multi-factor authentication. These measures help protect sensitive financial information and reduce the risk of fraud. Automated payments also reduce the human handling of financial data, further minimising security risks.

- Scalability: As your business grows, the volume of transactions you handle increases and manual payment processing can become an obstacle. Automated payments allow you to accommodate increasing transaction volumes without any additional resources. This scalability ensures that your business can continue to operate efficiently as it expands.

Contact our team at [email protected] to learn more about the opportunities to optimise your financial operations with Payop solutions.