Business in Europe: Opportunities and Prospects for the business from Ukraine and CIS Countries

Business development within the market of Ukraine and CIS countries does not allow to get the maximum benefit. The growth of entrepreneurial activity due to entry into the European market makes it possible:

- To attract new audience: more than 500 million inhabitants from 28 countries of the world.

- To increase the profitability of products (due to the solvency of Europeans, increased margins, etc.)

- To expand the sources of income.

- To cover new profitable segments that are inaccessible to entrepreneurs from most post-Soviet countries and Ukraine.

- To organize efficient logistics (the EU transport system is an ideal platform for this).

- To significantly increase production and sales.

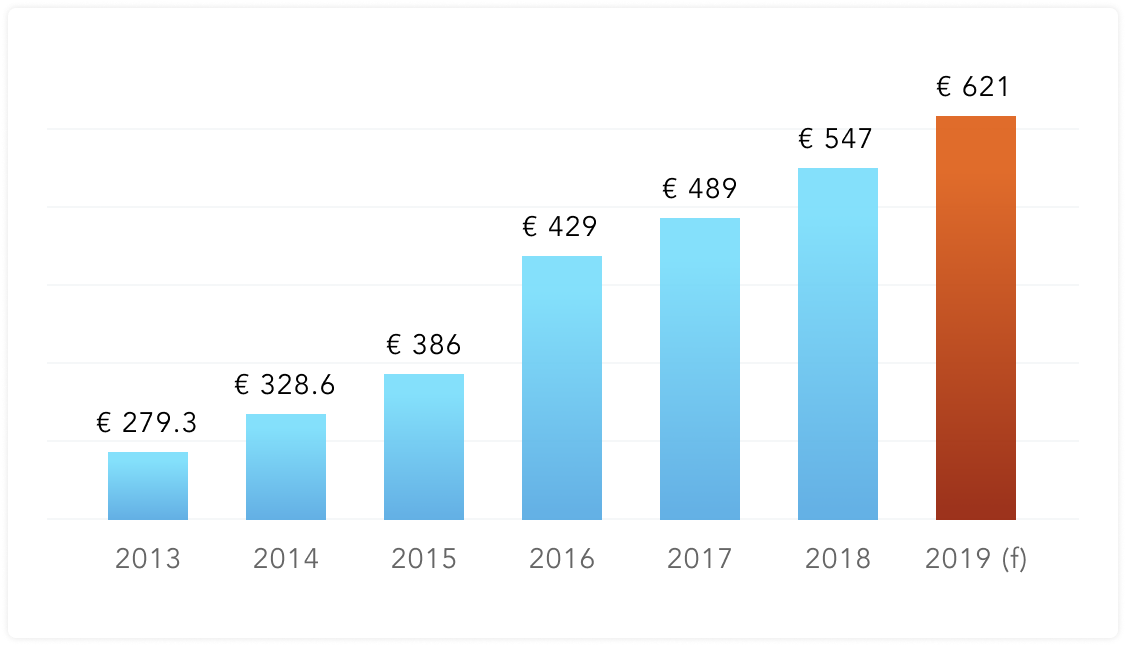

An essential feature of the European market is the rapid development of the Ecommerce sector. According to studies by the Ecommerce Foundation, by the end of 2019, online sales in Europe will grow by 13.6%, which will worth of more than €621 billion.

The dynamics of electronic commerce growth in recent years is as follows:

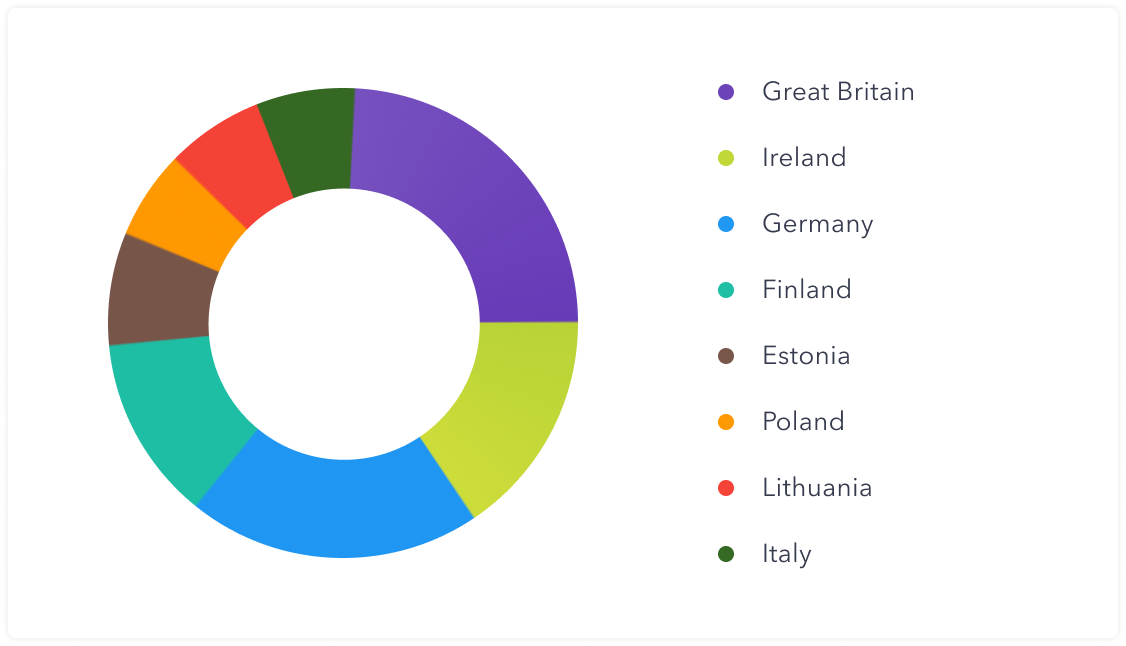

ETrading dominates in Western Europe. About 85% of residents of Switzerland, UK and Denmark regularly shop online.

The proportion of purchases made online in European countries:

Before conquering the business sites of America or Asia, it is worth trying yourself in the EU. Entering the European market is a reference point for the development of international trade. And not only for economic reasons. The main reason for this is that the European market is more flexible and does not require a fundamental change in business strategies:

- the mentality of Europeans is much similar and understandable;

- lack of language barriers;

- slight time difference.

The path to EEA involves:

- Study of market potential, key competitors and the target audience.

- The introduction of new quality standards in production, the study of product safety requirements.

- Development of logistics routes.

- Revision of the advertising campaign (not all advertising technologies of the CIS countries will be effective in the European market).

- Entering the market without physical presence.

- Study of the legislative aspects governing the business of the country.

- Adaptation of the financial system to the conditions of the EU country (not every payment system that Europeans freely use is available for entrepreneurs in the CIS countries).

The main problem of entrepreneurs who are not citizens of the European Union is the ability to open a Merchant account, a bank account in financial institutions, payment systems and electronic wallets of the EEA. If you need to immediately open several payment methods or several accounts, then the solution to this problem will drag on for several months.

This problem is solved by the PayOp payment aggregator, which allows you to quickly integrate into the European payment system and beyond.

Peculiarities of the payment systems of Europe

According to forecasts by Juniper Research, by 2024, online business transaction volumes will exceed $ 6 trillion.

About 83% of the world’s adult population now have a bank account, so payment by bank transfer is available to most. The most popular online banking systems in Europe are:

- SOFORT – operates in 13 countries in Europe, is widely used in Germany, Belgium, Switzerland and Austria;

- iDEAL – allows you to use the application of each individual bank, the most popular service in the Netherlands;

- GiroPay – serves more than 35 million consumers, the system is widespread in Germany.

However, not every bank can boast of a convenient application or a well-developed service on the site for payments. Moreover, many users do not trust the banking system.

Therefore, 55% of consumers use alternative payment systems, choosing payment aggregators.

Top 5 European payment systems:

- Google Pay – 1.2 billion users use it.

- PayPal – 200 million.

- Apple Pay – 143 million.

- GiroPay – 35 million.

- Universal payment gateways – more than 120 million visits per month.

Use of payment systems in European countries:

| Austria | Germany | Belgium | Czech | Denmark | Finland | Norway | Italy | Netherlands | Poland | Portugal | Russia | Switzerland | Spain | France | Sweden | United Kingdom | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EPS | + | ||||||||||||||||

| SEPA direct debit | + | + | + | ||||||||||||||

| Google Pay | + | + | + | + | + | + | + | + | + | + | + | + | + | + | + | + | + |

| Apple Pay | + | + | + | + | + | + | + | + | + | + | + | + | + | + | + | + | + |

| Visa | + | + | + | + | + | + | + | + | + | + | + | + | + | + | + | + | + |

| Mastercard | + | + | + | + | + | + | + | + | + | + | + | + | + | + | + | + | + |

| Bancontact | + | ||||||||||||||||

| MasterCardNigeria | + | ||||||||||||||||

| Paybylinks | + | ||||||||||||||||

| Diners Club | + | + | |||||||||||||||

| American Express | + | + | + | + | + | + | |||||||||||

| iDeal | + | + | + | ||||||||||||||

| eWallet | + | + | + | + | + | + | + | + | + | + | + | + | + | ||||

| Skrill | + | + | + | ||||||||||||||

| Mistercash | + | ||||||||||||||||

| Allopass | + | ||||||||||||||||

| Neosurf | + | ||||||||||||||||

| CMCIC Paiement | + | ||||||||||||||||

| Bank Transfer | + | + | + | + | + | + | + | + | + | + | + | + | + | ||||

| Cash on Delivery | + | + | + | + | + | + | + | + | + | + | + | + | |||||

| PrePay | + | + | + | + | + | + | + | + | + | + | + | + | + | ||||

| Hipay | + | ||||||||||||||||

| Yandex Money | + | ||||||||||||||||

| Qiwi | + | ||||||||||||||||

| Webmoney | + | ||||||||||||||||

| Paysafecard | + | ||||||||||||||||

| Charge Card | + | + | + | + | + | + | + | + | + | ||||||||

| Credit Card | + | ||||||||||||||||

| Debit Card | + | ||||||||||||||||

| PrePaid | + | + | + | + | + | + | + | + | + | + | |||||||

| Sofort | + | + | |||||||||||||||

| Slimpay | + | ||||||||||||||||

| Quickpay | + | ||||||||||||||||

| eInvoices | + | + | + | ||||||||||||||

| Giropay | + | ||||||||||||||||

| RatePay | + | + | |||||||||||||||

| Payone | + | ||||||||||||||||

| Paymill | + | ||||||||||||||||

| Prepaid Voucher | + | + | |||||||||||||||

| Prepaid Card | + | + | + | + | |||||||||||||

| Mybank | + | ||||||||||||||||

| Cartes Bancaires | + | ||||||||||||||||

| Dankort | + | ||||||||||||||||

| Klarna | + | + | + | + | + | + | |||||||||||

| PayPal | + | + | + | + | + | + | + | + | + | + | + | + | + | ||||

| Online banking | + | + | + | + |

Key Features of Payment Systems:

| Security | Payment limits | Cost of use | Currency | Service Delivery Method | |

|---|---|---|---|---|---|

| Google Pay | Biometric Authentication System | Not set | 30% of the transactions amount | Multicurrency | By means of Android gadgets |

| PayPal | Secure connection after entering login and password | In some countries, up to $3000 | Different terms in different countries | Multicurrency | Directly |

| Apple Pay | Provided by means of security functions built into the hardware and software of the device. | Some countries have a limit, above which you must enter a PIN code. | 0,5% to 0,12% | Multicurrency | Runs on iOS |

| Visa | Data encryption, password, confirmation of operations via SMS | Up to 2200 euros per day | The rate depends on the type of account and the type of transaction | European currencies | Global payment system, which acts as the basis for monetary operations of different banks |

| Mastercard | Data encryption, password, confirmation of operations via SMS | Up to 1500 per day | Depends on the type of transaction and the bank to which the transfer is made. | Multicurrency | The system operates on the basis of its own payment platform. |

| SEPA direct debit | All operations take place only after the payer is entitled to a direct debit | The limit is set by the user | 5 to 7 euros per transfer | Euro | Based on direct debit system |

| Diners Club | Password cards and CVV 2 | Up to $500 per day | Depends on the type of operation | Multicurrency, base currency – local of the account holder | Diners Club International banking system |

| PayPal | Data encryption, payment protection program | The limit is set by the user in his account | 0,4% to 3,4% | Multicurrency | Own payment platform |

| Trustly | Encryption, user information is not stored | Not set | Percentage depends on transaction amount | EUR, PLN, SEK and DKK | PayPal and TransferWise |

| Verkkopankki | Bank uses PIN / TAN system | Up to 10000 Euro | Depends on user account type | Multicurrency, cryptocurrency | Through Finnish Online Banking |

| TrustPay | No registration of accounts or numbers, passwords, accounts | The user can set the limit himself | The price depends on the type of transfer: intra-bank or cr | Multicurrency | Directly with a bank |

| Klarna | Personal Identification | Not set | Depends on the online store | Type of currency varies by country | Klarna acts as an intermediary between buyer and seller |

| Skril | PCI DSS L1 | Up to 500 euros once, up to 1500 euros per month | 1,99% to 3,99% | All European Currencies | Electronic wallet with a link to the user’s bank |

| Przelewy24 | PIN / TAN System | Limits depend on the type of transaction | 1,9% | Mostly Zloty and Euros, other European currencies can be converted | Based on online banking transactions |

| PayU | Flexible confirmation system for each charge | The limit is set for security purposes; the user can change it. | No withdrawal commission | Multicurrency | Online platform with a combined payment method |

| My Bank | Two-factor authentication | Not set | Depends on transaction type | Depends on transaction type | Based on SEPA tools |

| Multibanco | Binding to various warning systems, login and password | 200 Euro per transaction | Depends on the type of card | Base Currency – Euro | SIBS Network |

| iDEAL | Two-factor authentication | No more than 500 euros per transaction | Depends on the type of transaction and the type of the account | Base Currency – Euro | Directly with a bank or through PayOp |

| Giropay | Encryption of buyer’s bank details (PIN and TAN) | Up to EUR 50,000 per transaction | Depends on the transaction amount | Euro | Linking to the buyer’s bank |

| EPS | Encrypted customer data | Depends on the type of account | Depends on the bank of the user | Multicurrency | Through bank transfers |

| Bancontact | Identification using the login and password | Depends on the bank to which the account is linked | Depends on the bank to which the account is linked | Currencies of European countries, cryptocurrency | Via PayOp |

The acceptance of payments on the site sent from the electronic wallet is very popular. Thanks to the principle of biometric identification, electronic wallets today are absolutely safe and as convenient as possible. The most popular among Europeans for several years now are Google Pay, Apple Pay, Android Pay, Skrill, Alipay, WeChat, Qiwi, Yandex.

Instant financing systems are gaining popularity – services with an open credit line, monthly repayments and flexible loan terms. They are used for urgent purchases, payments for a large amount. The most popular program of this type in Europe has become Klarna – a service that allows you to receive the goods now and pay in stages within a few days. For the use of money, the service, of course, charges a fee.

PayOp payment aggregator – a convenient platform for financial transactions in Europe

PayOp is a payment aggregator that combines more than 300 payment methods. PayOp unhinderedly opens up a payment opportunity to conduct a transaction in Europe or another part of the world without the need to have a representative there.

The geography of PayOp coverage – more than 170 countries. The company’s headquarters are located in the UK, Singapore, USA and Ukraine. PayOp has a dedicated software development team in its arsenal.

Thanks to the aggregator, it is possible to establish the acceptance of card payments, payments from electronic wallets, payment by alternative methods.

The PayOp platform supports more than 130 forms of payment, including acquiring. These are:

- international cards (Visa and Mastercard, American Express, Hipercard, Discover, Bancontact, Cabal, Rupay, ELO, Astropay, Diners club, Aura, Nativa, Maestro, Lider, Cardial and others);

- electronic wallets;

- bank transfers;

- online banking, transfers using mobile applications and services (Ideal, Giropay, SEPA, Trustly, SafetyPay, FPX, Poli);

- cash transfers through the services of Paysafecard, SafetyPay, Dragonpaу and others;

- payment through mobile operators;

- instant withdrawal of consolidated funds by bank transfer.

Indisputable advantages of PayOp are:

- more than 130 payment instruments;

- multicurrency, cryptocurrencies support;

- instant currency conversion at the current rate;

- work with highisk merchants;

- operational online invoicing;

- accessibility for the client from anywhere in the world;

- verification of new Internet projects of merchants in 1 day;

- card tokenization in 1 click;

- high level of security with PCI DSS L1.

PayOp will become indispensable:

- For businessmen who want to expand the range of payment opportunities or the geography of the project.

- To launch a new project with a different risk level or with a different direction.

- For entrepreneurs who need an uninterrupted payment system.

Owners of online stores have learned to overcome information boundaries and reduce the geographical distance in a matter of hours. It’s time to get rid of the restrictions in the financial and payment sector. PayOp is the best confirmation that it is real today.

Details can be found at https://payop.com