How to chargeback on PayPal in 2021?

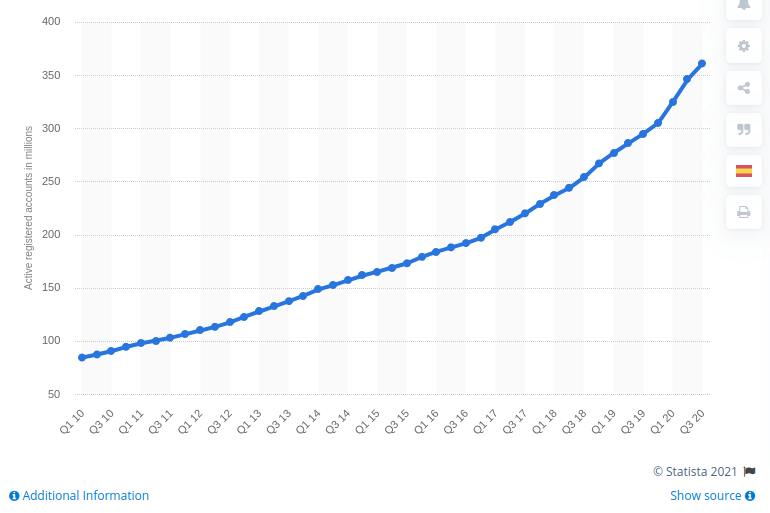

The PayPal platform is becoming more and more popular every year, which makes the question of how to do a chargeback on paypal more and more urgent.

The data shows that in the third quarter of 2020, the number of active users of the system reached over 360 million.

Every day a record number of transactions are made on this platform, and therefore knowing how to chargeback on paypal and win will definitely not be redundant for you.

In this article, we’ll take a look at the basics of chargebacks on the world’s most popular platform.

What is a paypal chargeback and what reasons can it arise?

A chargeback is a fairly standard procedure for cancelling transactions made by cards from one of the popular payment systems. In other words, the customer sends a demand to the card issuer to revoke their payment and return the amount of charged funds.

A chargeback can be caused by several reasons:

- The customer has been charged more than once;

- The customer doesn’t remember making the credit card payment;

- The item the customer received was damaged;

- The customer did not receive the item from the seller at all;

- The customer did not complete the transaction authorization procedure.

In this case the merchant should find out how to prevent a chargeback via PayPal. There is a special offer for this, which provides a guarantee of order verification and an absolute guarantee of a refund if a chargeback situation arises.

In addition, it is not unreasonable for the seller to sign up for a seller protection policy, which in some situations will allow the seller to not pay a fee on a chargeback.

How is the chargeback process with PayPal different from other platforms?

More often than not, the chargeback process begins with the payment processor contacting the credit card company that issued the credit card that was used to make the payment. But not in the case of Paypal, the service of which does not have this authority.

In this case, in order to request a chargeback, you need to go through the following steps:

- The customer must request a refund from the company that issued the credit card. An e-mail must be sent to the company to request it, along with a document that shows the buyer has completed the transaction. Also the buyer may call the company, if this will be more convenient for them;

- When the request is received from the cardholder, the issuing company contacts PayPal, withdrawing the money from their account;

- The PayPal platform puts a stop on the refund. From that point on, the money is untouchable.

Through e-mail, the merchant and customer will be notified, and PayPal will ask for the data needed to successfully return the payment.

Paypal how to chargeback or some subtleties to keep in mind

Once an order has been placed, the buyer will have 120 days to request a refund on the transaction.

Sellers will only have 10 days to dispute the chargeback in any way.

Typically, the refund process takes a couple of weeks. If the case turns out to be complicated, this period can take up to 75 days.

How to prevent paypal chargeback for merchants?

In most cases of chargebacks it is the buyer who has priority over PayPal, while the merchant is left to his own devices and is not protected.

To reduce the number of possible disputes, merchants should pay attention to the following tips:

- Describe the website’s refund policy. Post information in a prominent place so a user could find it with ease;

- Try to settle the issue without involving a bank. Ultimately, both sides will benefit from such a decision;

- Don’t hide contact information. If the client can promptly discuss the arisen dispute with the support service, the chances of a successful dispute resolution are significantly increased.

The bottom line

Chargeback is an undesirable phenomenon for any online business. A business loses its goods, pays a fine, get their clients mad and risks falling under the sanctions of payment systems. If the number of chargebacks reaches a certain value set by the payment system, then it is blocked from accepting payments by credit cards. The optimal solution would be to choose a payment processor that provides not only software for protecting against fraudulent transactions, but also helps in resolving disputes related to chargebacks.