iGaming payment processing: Taking your business across borders

Expanding your business across borders in the competitive and rapidly evolving iGaming world offers immense growth opportunities. However, this expansion comes with its own set of challenges, not least of which is the complex issue of payment processing.

Managing cross-border payments efficiently is crucial for the success of an iGaming business in international markets. This article delves into the essentials of payment processing for iGaming businesses looking to expand globally, highlighting the challenges, solutions, and strategic considerations that can pave the way for smooth financial transactions.

Understanding the landscape of global payment processing

The first step in managing cross-border payments is understanding the diverse landscape of global payment processing. Each country has its regulatory environment, preferred payment methods, and banking systems. For instance, while countries like Germany prefer bank-based methods such as SOFORT, China relies heavily on e-wallets like Alipay and WeChat Pay.

For iGaming businesses, this means that a one-size-fits-all approach to payment processing doesn’t work. Researching and understanding the preferred payment methods in each target market is essential. This localised approach not only enhances customer satisfaction by providing familiar payment options but also helps in navigating through local regulations and compliance requirements.

Regulatory сhallenges and сompliance

One of the biggest hurdles in international payment processing for iGaming is dealing with varied regulatory landscapes. Each jurisdiction has its own rules regarding online gambling, and these regulations can affect everything from the types of transactions allowed to the reporting requirements for anti-money laundering (AML) purposes.

To successfully manage these regulatory challenges, you must ensure your company fully complies with local laws. This might involve obtaining licenses, adhering to local financial regulations, and implementing robust KYC (Know Your Customer) and AML procedures. Failure to comply can result in hefty fines, legal issues, and damage to reputation.

Partnering with the right iGaming payment processor

Choosing the right payment processing partner is critical when expanding your iGaming company globally. A good payment processor not only handles the complexity of multiple currencies and payment methods but also provides insights into local markets and regulatory advice.

The gateway you select should also be capable of integrating seamlessly with local banking systems, ensuring quick and secure transaction processing. In addition, it should implement advanced features such as fraud detection algorithms, risk management tools, and real-time currency conversion. These technologies reduce the risk of fraud, minimise transaction errors, and ensure compliance with local and international financial regulations.

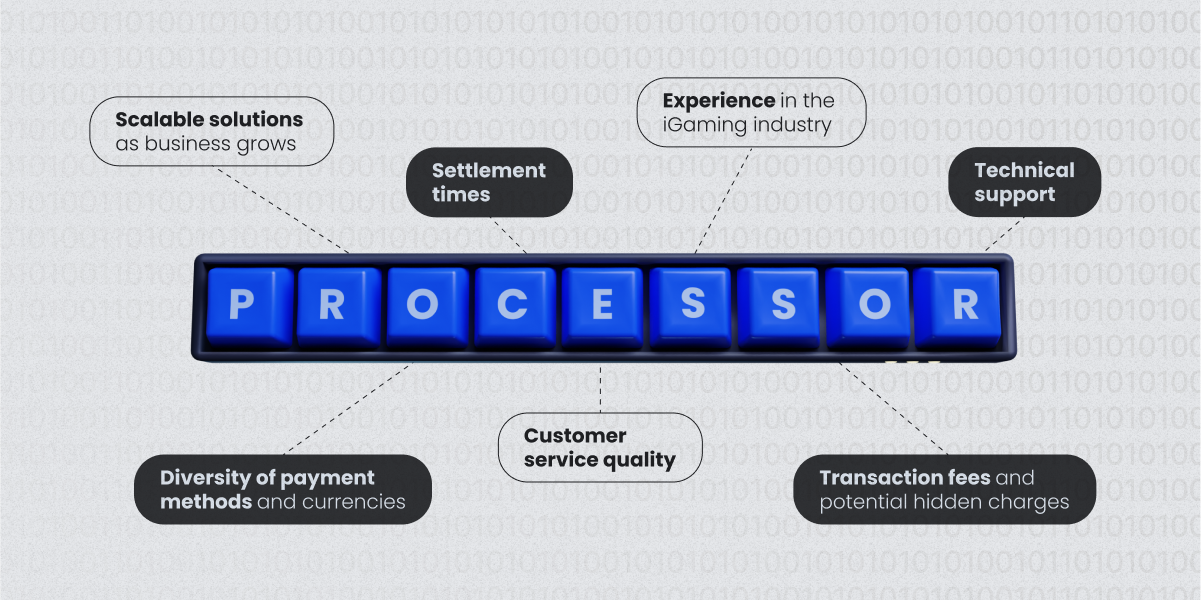

So, when selecting a payment processor, consider factors such as:

- processor’s experience in the iGaming industry

- diversity of payment methods and currencies

- ability to provide scalable solutions as your business grows

- transaction fees and potential hidden charges

- settlement times

- customer service quality

- technical support

Ensuring the security of customers’ data and money during iGaming payment processing

Building customer trust through secure transactions is vital for iGaming businesses expanding internationally. Adopting industry-standard security measures like Secure Socket Layer (SSL) and Transport Layer Security (TLS) encryption is essential. These technologies protect sensitive data during transmission, ensuring that personal and financial information is secure from unauthorised access.

Additionally, incorporating robust authentication methods, such as two-factor authentication (2FA), adds an extra layer of security. This could involve a combination of something the user knows (password), has (security token), or is (biometric data), significantly reducing the risk of fraud and enhancing customer confidence.

Moreover, transparency about security practices is crucial for building trust. Your iGaming platform should clearly communicate its security measures and data handling policies, explaining how customer information is protected and used.

Regular updates about new security features and data protection tips also help maintain an ongoing dialogue with users and show your business’s commitment to data security. These practices help attract new customers and retain existing ones, bolstering the platform’s credibility and success in the competitive international market.

Expand your iGaming business with Payop

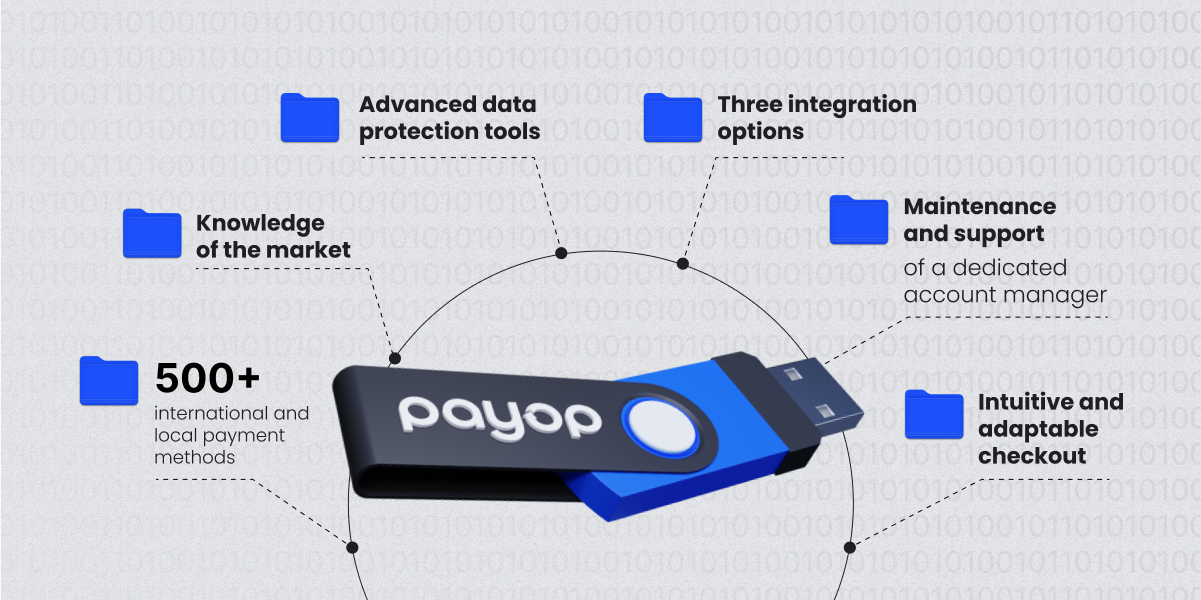

Payop is an ideal partner for your iGaming businesses aiming to expand globally. We offer tailored payment processing solutions that cater to various international needs:

- Over 500 international and local payment methods and 100 currencies covering 170 countries

- Knowledge of the market and needs of iGaming businesses

- Adherence to international standards such as KYC and AML regulations

- Advanced data protection and fraud prevention tools, protecting both your business and your customers

- Three easy integration options to connect all payment solutions at once: our reliable API, technical integrators and Payop plugins

- Constant maintenance and support of a dedicated account manager

- Intuitive and adaptable checkout

To learn more and get individual consultation contact our team at [email protected].