How payment providers prevent online fraud?

When merchants start an online business, they often do not think about protecting the personal data of customers properly. This is especially true for businesses that have a small number of transactions per day. However, given that almost every business seeks to scale, ignoring this threat can cost you a lot.

Based on The Nilson Report, the losses that payment systems, merchants, acquiring banks, emitters, plastic card users suffered from online fraud are estimated at $ 27.85 billion as of 2018, which makes this problem very seriously and undermines the credibility of online payments.

With the rapid growth of e-commerce, businesses should re-evaluate their attitude to the possible risk and get acknowledge with modern tools and methods to minimize the number of crimes.

What is payment fraud?

Simply put, payment fraud is any type of false or illegal activity with online transactions, made by cybercriminals. Fraudster deprives a victim of funds, property, financial interest, or any other private information through the Internet.

What types of payment fraud are exist?

Phishing. This is one of the types of Internet fraud to obtain illegal access to confidential user’s data.

Fraudsters get user data under various, at first glance, innocuous at first glance: verification of authorization on the site, the need to unsubscribe from spam in email, payment for a purchase at a lower price, the need to install a new application. Simply put, fraudsters try to access your payment card in any way. Remember that you can only reliable websites and never follow suspicious links from unknown people.

Merchant identity fraud. This type of online fraud has a more complex scheme. Criminals create fake merchant accounts and start charging the client’s credit cards. After collecting the money they close accounts. This type of scam is especially dangerous for legitimate businesses. Thus, customers can ask for a chargeback and you are the one who will suffer, but not fraudsters.

Friendly fraud. When a customer is dissatisfied with a good or a service they can ask for a refund. However, people also frequently start a chargeback procedure to receive money back. Thus, they push banks to make a refund forcibly. This type of fraud has fewer negative consequences for merchants because you can always negotiate with your customers. However, some fraudsters may use friendly fraud to charge the money back and keep a good.

Pagejacking is a process of making a copy of a primary website to replicate the original one. To reach this purpose, pagejackings copy full source code of a legitime website and start generating traffic. The consequences are varied, start from clients’ losses, and finish total business collapse.

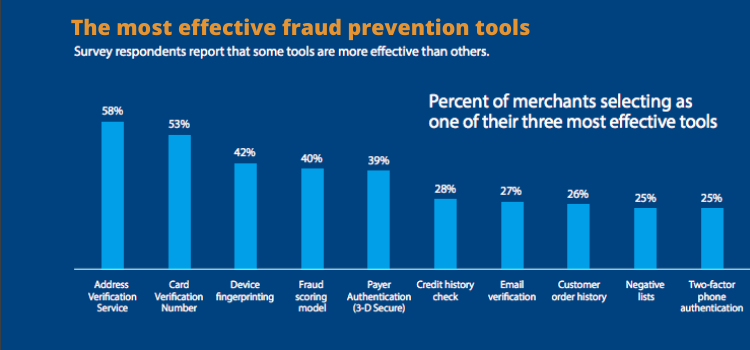

What are the most effective fraud prevention tools?

- Address Verification Service (AVS)

AVS system was developed by international payment processors and is used to detect suspicious credit card transactions. This software compares the cardholder’s billing address with the billing address stored in the issuing bank. After verification, the payment gateway receives a response, as a result of which the transaction is confirmed or rejected.

- Card Verification Value (CVV)

CVV is a sequence of features that help identify the cardholder and minimize the risk of fraud. It is also called CVC or CSC.

Usually, there are several implementations of CVV on plastic cards. In the first case, there is a magnetic stripe, which is implemented along the back of the card. Such a stripe may contain a large amount of data. In the second case, there is a sequence of numbers that are located on the card itself.

- Device ID

A device ID is a unique sequence of letters and numbers that every device has and identifies every smartphone, tablet, PC worldwide. It is one of the easiest ways to identify users and serves as an additional security layer. Some companies may track this number to collect data about suspicious or fraudulent activities.

- Fraud scoring model

Fraud-scoring is a type of scoring that is based on a statistical assessment of the probability of fraudulent actions on the part of a potential client.

Fraud-scoring is used mainly as a specific barrier in obtaining fraudulent loans. The system, automatically, can compare customer data with so-called “black” and “gray” lists, make inquiries to the credit bureaus and other external databases.

- 3D-secure

The 3D-secure technology was developed by such payment giants as Visa and MasterCard and is used as an extra layer of security for online credit and debit cards.

3-D Secure adds another authentication step for online payments, which allows merchants and banks to ensure that the payment was made by the cardholder to protect themselves from fraudulent transactions. A cardholder must enter a one-time password to confirm payment operation.

Which payment option can offer additional security like fraud protection?

There are various payment providers in the market and they all offer different ways to protect transactions’ data. The best way to protect your money is to choose one that fits your business needs the best. We, at PayOp, understand how important the security of our customers is and we provide only modern methods of online fraud prevention, including two-factor authentication, 3D-secure, tokenization, and other methods. If you still have questions, you can always contact us.