Pay-by-Bank payments explained: Step-by-step guide

Pay-by-bank payments are emerging as a significant trend. Their simplicity, convenience, and high level of security make them a popular choice among merchants and consumers. So, let’s take a look at the Pay-by-Bank technology and see how it works step-by-step.

The principle behind Pay-by-Bank

Pay-by-bank payments are driven by the open banking concept and modern digital technologies, such as Application Programming Interfaces (APIs). APIs play a key technical role, allowing third-party providers to securely access bank data with user consent. For consumers, this means the possibility of paying for goods and services directly from their online banking accounts.

For Pay-by-Bank payments to function effectively, there must be a collaboration between three main financial entities:

- Banks need to provide robust, user-friendly, and secure digital banking services.

- Payment processors act as intermediaries who manage the technical integration with multiple banks, ensuring merchants can accept payments from various banks without signing numerous contracts.

- Regulatory bodies ensure that all participants adhere to financial standards and protocols to protect consumer rights and guarantee transaction security.

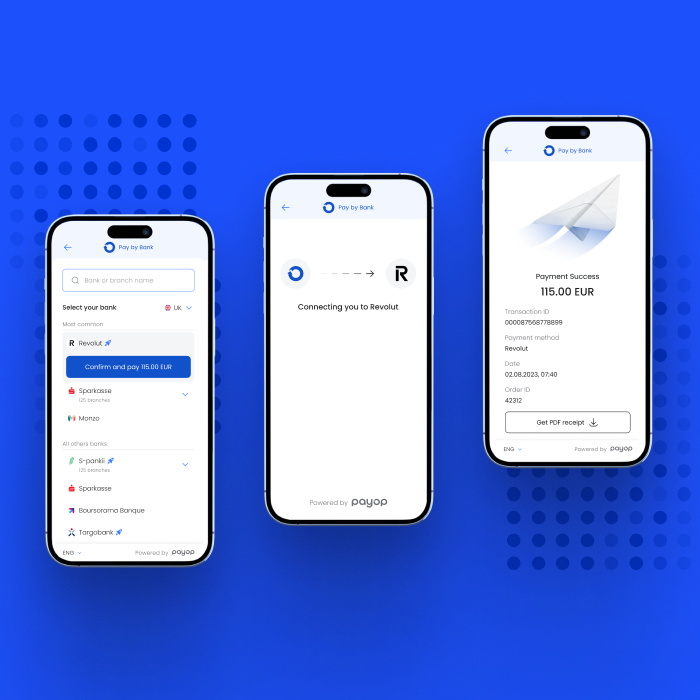

How Pay-by-Bank payments work step-by-step

Pay-by-Bank offers consumers security and simplicity in use. By eliminating the need to enter sensitive data on the merchant’s website, this payment method significantly reduces the risk of data theft and saves time at the checkout.

Here is a detailed description of how Pay-by-Bank payments work:

Step 1: Choosing the payment option

At the checkout, the consumer selects Pay-by-Bank as their preferred payment method.

Step 2: Authentication

Once the payment method is selected, the consumer is redirected to their bank’s mobile app or online banking portal. Here, they need to authenticate themselves using their usual login credentials or biometric verification, ensuring that the rightful account holder initiates the transaction.

Step 3: Authorisation

After logging in, the consumer reviews the payment details, including the amount to be paid and the payee’s information. Upon confirmation, the consumer authorises the transaction directly from their bank account.

Step 4: Confirmation

The bank processes the transaction in real time, sending a confirmation to the merchant’s payment system. This confirmation signifies that the funds are authorised and the payment will be processed.

Step 5: Notification

Both the merchant and the consumer receive notifications about the transaction status. The merchant is assured of payment receipt, and the consumer is informed that the payment has been successful.

Pay-by-Bank benefits with Payop

Payop’s Pay-by-Bank offers numerous benefits over traditional methods. These include enhanced security due to direct bank engagement, lower transaction fees, and faster processing times. Consumers enjoy a seamless payment experience without the need to enter credit card details, while you, as a merchant, benefit from immediate payment confirmations and reduced chargeback risks.

Learn more about other benefits of this method in our blog or directly contact our team at [email protected].