How to accept payments online?

One of the most vital challenges in doing business is accepting payments. Any business’s primary goal is profit, regardless of what you do: cutting trees or selling skins for computer games. World trade goes online faster and deeper than ever before (hello, after-COVID times!), so getting the ability to get paid through the Internet is essential for any entrepreneur.

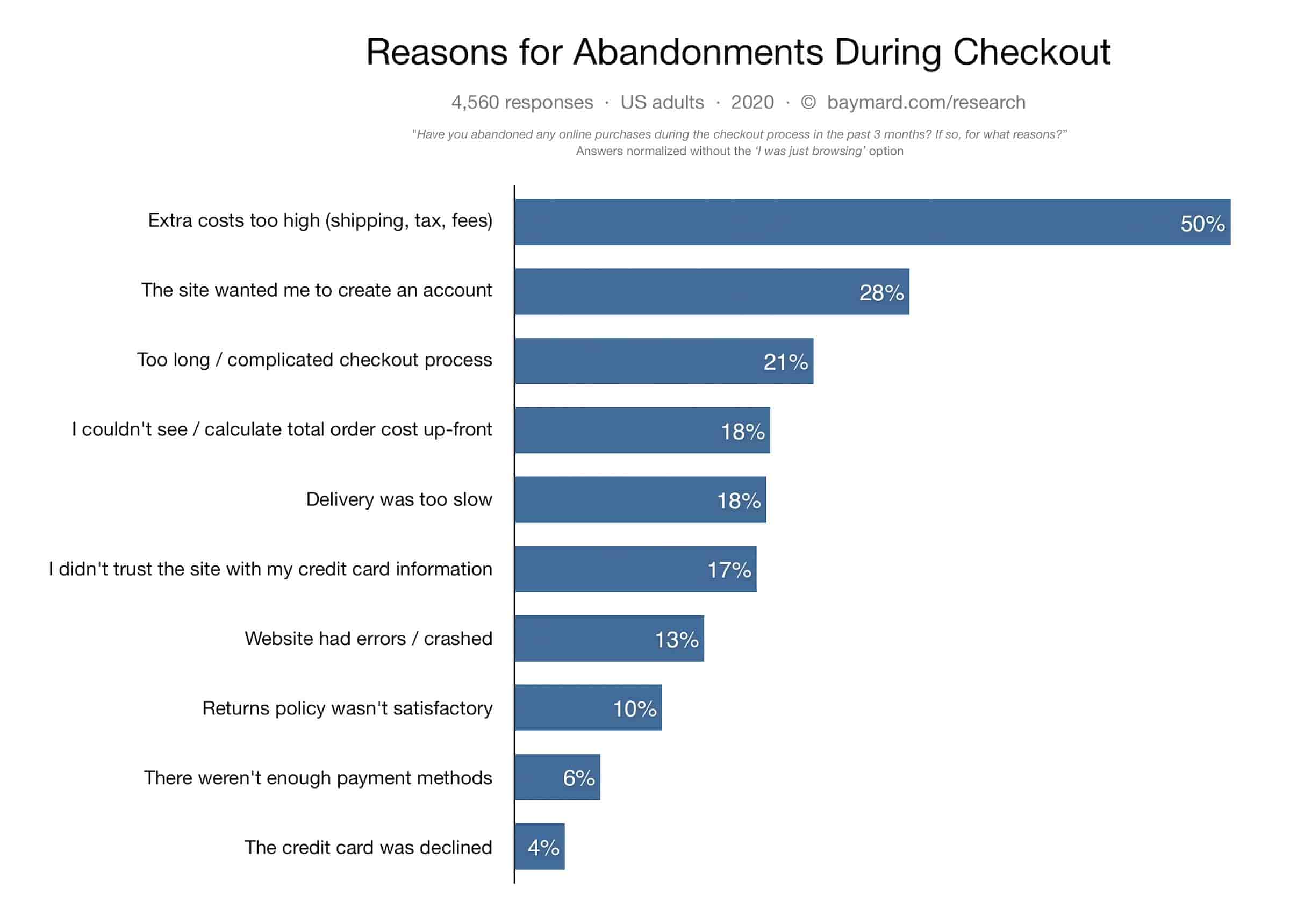

The ability to make payments quickly and easily is one of the parameters that can increase your conversion rate and bring you more customers, as a result — more money. But how can you do it quickly and seamlessly if your Internet knowledge is limited to scrolling social media and visiting weather forecasting websites? This article will give you basic knowledge about online payment methods and practical steps to start getting money from the net, even if you didn’t do it before. Before we start, rule number one: make it as easy for your customers as possible. Statistics show that, among other reasons, over 20% of users do not complete a purchase because of a long or confusing checkout process.

Thus, every business owner should study the process of setting up payment acceptance on the site as thoroughly as possible.

What does the payment process look like?

Online payment processing is much more complicated than it sounds. Although the transaction takes a few seconds, it involves several participants who perform complex operations. Let’s take a look at the main components of transaction processing.

- Payment gateway

A payment gateway is a program that integrates into a merchant’s website and authorizes online payments. In other words, it is an intermediary between the bank and the client. When a customer completes a transaction, the payment gateway receives and transmits payment data to the appropriate banking organizations and reports whether the transaction was approved.

Why is it impossible to transfer information directly to the payment system? — It’s all about the PCI DSS international security protocol requirements. To integrate a website with a payment gateway software, a merchant must provide certain business information. There are many payment providers, and you need to choose the one that perfectly fits your business model.

- Merchant account

While payment is processing, it should be noted that the funds do not immediately go to the company’s bank account. They stay on the merchant account for some time (usually up to three days). It occurs, again, for security reasons. The withdrawal is processed in various ways depending on the supplier’s capabilities. Without a merchant account, the merchant will not be able to accept payments. You can get a merchant account at a bank or a licensed financial institution.

In some cases, the bank may refuse to open a merchant account. It may happen because of the level of risk in the industry or insufficient information provided. In this case, a third-party payment processor would be the best solution. Such organizations provide a payment gateway to merchants who do not have their merchant accounts.

The type of online payments to accept

By providing users with a wide range of payment solutions, you allow them to pay how they got used to, which will undoubtedly increase loyalty and shorten the checkout time. Your payers will be glad to see the payment method they use every day. See the “rule number one” — the easier it is for your user, the more likely the purchase will happen. Let’s take a closer look at the main methods to look out for:

- Credit and debit cards

These are the most widely used online payment methods. All online business owners must provide their customers with the ability to pay using Visa and MasterCard.

- ACH payment processing

ACH payments are funds transfers from a customer’s bank account to a merchant’s account through an automated banking network. This solution is available for US customers and is used for various financial transactions. For this kind of transaction, a payment gateway is not obliged, but a merchant account is still required. ACH processing fees are lower than credit card processing and are charged either per transaction or at a flat rate.

- Mobile payments

Mobile payments mean all financial transactions that are provided using a mobile device: smartphones, smartwatches, and tablets. With the help of the service, users can pay for popular services from their mobile accounts. It’s fast, convenient, and safe. Clients can replenish their gaming account, pay for utilities, internet, television, fines, repay loans, and put money into their account.

- Invoicing

Invoicing is a method of collecting payments for a product or service already delivered via email. If necessary, invoicing can be automated for easy collection of payments. This method is the most suitable for recurring payments. No matter what business you operate, the more payment methods you support, the more potential customers you can attract.

The easiest way to install an online payment gateway on your website

Let us do the job for you! PayOp payment gateway provides acquiring services for 170+ countries. Register now and get access to 400+ alternative payment methods around the world. Sell your products and services worldwide without borders and let your customers pay using their payment methods. We offer easy integration with your website so that you can receive payments quickly and seamlessly directly on your merchant account.

Still got any questions? — Our sales team will be happy to assist you! Get in touch today, and start globalizing your business tomorrow! www.payop.com