The best Payment Gateways in Singapore

Payment gateways create the financial infrastructure between merchants and their customers. The key factor is providing an uninterrupted communication channel to transfer funds by a convenient method for the client.

Choosing the optimal payment gateway is in many ways one of the most critical decisions in starting a business. Among other things, the payment gateway must be secure, offer various financial services, and be user-friendly.

Let’s take a look at the basic requirements when choosing a Singapore payment gateway.

Payment gateway selection factors

Integration type

The type of integration means how the payment page will look and function. When working with a payment gateway, the client should not experience any inconvenience. The payment page should be simple and, preferably, integrated into the merchant’s site.

There are several main types of integration that have their advantages and disadvantages, consider them:

- API-integrated gateways. This type of integration is the best because all operations occur without redirecting the user to an external resource. In addition, the merchant can adapt the page to the design and needs of the site. The disadvantage of this method is that the responsibility for data security falls on the business owner. However, many Singapore payment gateways such as PayOp offer built-in anti-fraud mechanisms and PCI DSS compliance.

- The Hosted Payment Pages. This type of integration is much simpler than the previous one. To accept payments, the client only needs to place the payment page code on the website. The responsibility for security lies with the processing company. The payment page will redirect the client to the payment processor server to complete the operation. In some cases, this can negatively impact conversions.

- Split payment gateways. Checkout occurs on your site, but the other half of the process, payment processing, is processed on the gateway site. It allows merchants to streamline the payment process, but they won’t fully control the user experience.

Payment methods

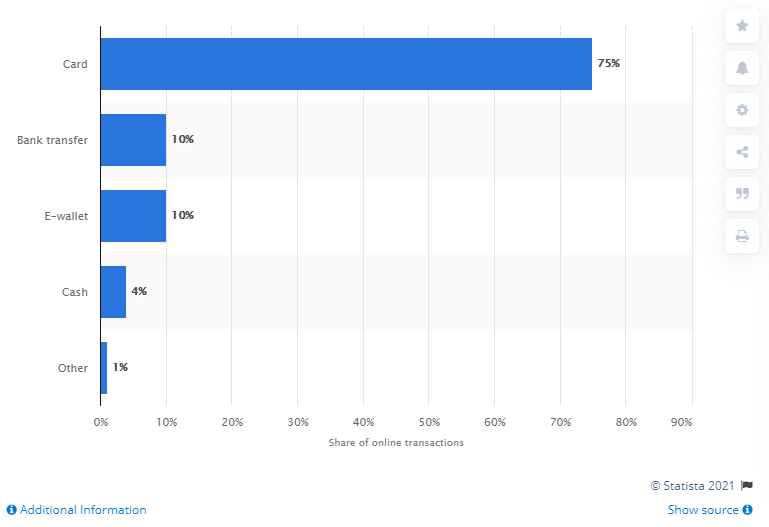

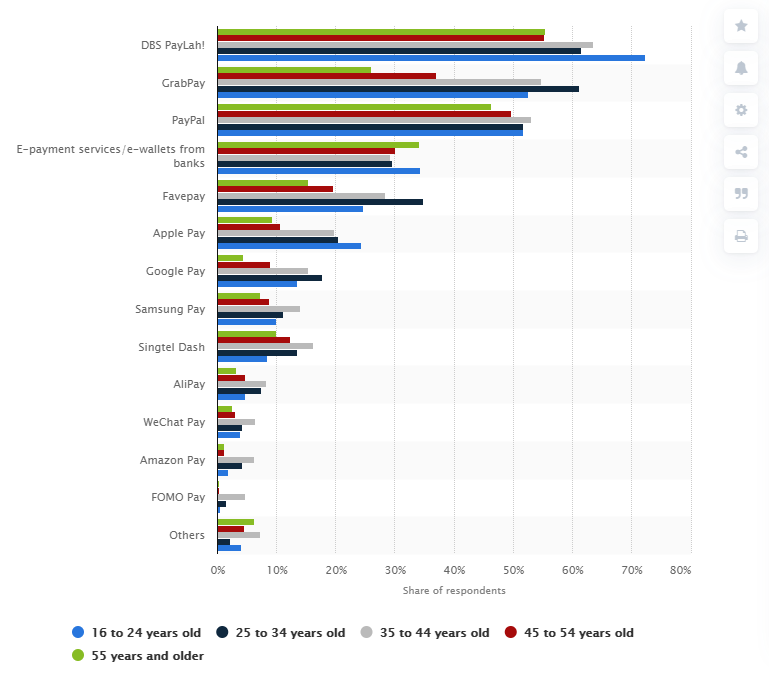

The payment gateway should provide as many payment methods as possible. For residents of Singapore, for example, cards are the most popular online payment method for 2020.

But that doesn’t mean you can brush off the rest of your audience. Alternative payment methods are becoming more and more popular not only in Singapore but all over the world. PayOp payment gateway, for example, provides the ability to accept payments by credit and debit cards and more than 300 alternative payment methods worldwide.

Fees

Most of the controversy arises when it comes to price. Many business owners strive to choose the cheapest payment gateway for processing payments in Singapore. Sometimes this tactic pays off. But in most cases, under low commissions, the merchant will receive much fewer services or, worse, various hidden commissions.

Merchants shouldn’t chase the price. It is better to pay a little more but get a stable platform to withdraw funds without any problems.

Coverage

Payment gateway geography should not be limited to Singapore. Perhaps the merchant wants to scale and bring the business to an international level in the future. In this case, they will have to look for another payment processor, which is an extra expense.

Safety

Most financial institutions offer built-in fraud detection and prevention software. In addition, all of them must comply with the PCI DSS requirements. The most common and reliable method is 3D-secure – a method in which the user must confirm the transaction by entering a one-time password. Modern payment gateways are actively implementing artificial intelligence and machine learning.

Based on the above data, let’s compare payment gateways that provide services both in Singapore and internationally.

Top 5 Singapore payment gateways

Braintree

Braintree is a state-of-the-art online credit card payment solution proprietary to PayPal.

The company is focused on international business and covers more than 40 countries.

Integration of the payment gateway is provided through the API. The company provides support in installing a payment gateway. Acceptance of payment is also possible through an electronic wallet.

Braintree features:

- Commission for a standard transaction: 2.9% + 0.3 $;

- Additional protection with Braintree Vault;

- ACH payments;

- Cryptocurrency processing.

PayOp

International processing platform PayOp offers merchants maximum benefits with the Singapore payment gateway. The company processes payments from 170 countries of the world, except for sanctions.

Acceptance of payment is possible by the following methods:

- Cash;

- Online banking;

- Online wallet;

- Credit and debit cards;

- Prepaid cards.

PayOp features:

- Commission for a standard transaction: 2.4% + 0.2 $;

- Working with high-risk industries;

- Acceptance of payments without a merchant account;

- More than 300 payment methods, both local and global.

HitPay

HitPay is a Singaporean payment gateway.

The organization enables shoppers to make secure, one-click purchases across multiple channels. This includes e-commerce platforms like Shopify, social media platforms like Facebook and Instagram, and retail stores.

HitPay features:

- Commission for international payments: 2.7% + 0.35 $;

- Accept payments via PayNow, credit cards, debit cards, AliPay, and WeChat Pay;

- Integration with popular e-commerce platforms: Shopify, WooCommerce, PrestaShop, Magento, Wix;

- More than 30 processing currencies.

Eway

EWay is one of the simplest and most user-friendly payment gateways in Singapore. The system supports integration with over 250 e-commerce platforms. EWAY also provides reliable and secure fraud protection with its built-in Beagle Lite system.

Eway Features:

- Commissions for international payments: 3.4% + 0.4SGD $;

- 24/7 technical support;

- Fast integration via iframe;

- Token payments;

- The payment gateway is available in 5 countries: Australia, New Zealand, Hong Kong, Singapore, Macau.

DBS PayLah

DBS PayLah is an online payment application that is Singapore’s leading payment processor for 2020.

You don’t need to have a bank account to use the app. For those who have it, the function of accepting funds directly to a bank account through the auto-debit function is available.

DBS PayLah features:

- PayLah allows you to pay using a QR code. This method is already supported by many merchants and some taxi services;

- Fast integration via API or hosted payment page;

- Recurring payments;

- DBS PayLah payment link;

- Virtual terminal.

The bottom line

The choice of a payment gateway will affect your business performance. High-quality software ensures high data reliability, the throughput of payments, and improves user experience. Conversely, if you are guided only by transaction fees, then you can dramatically degrade conversion rates due to poor quality service.

Each Singapore payment gateway is unique. That is why it is necessary to comprehensively evaluate the system and understand what advantages it will give you.

If you want to work with the PayOp payment gateway, please check out our solutions or register a free account and start the verification procedure.

Happy processing!