What are credit card processing fees?

With the introduction of a lockdown in most countries and the transition to a remote format of existence, many people have to master alternative options for familiar things.

For example, e-commerce. According to Adobe Analytics, in the first quarter of 2021 alone, global e-commerce sales growth increased 38% over the same period in 2020.

What does this mean for business owners? It’s simple: if you are an online business owner, connect as many payment methods as possible. Start with the most popular ones. If you only have an offline retail outlet, we advise you to create a company website. Thanks to modern website builders, you can create a professional website even without programming skills.

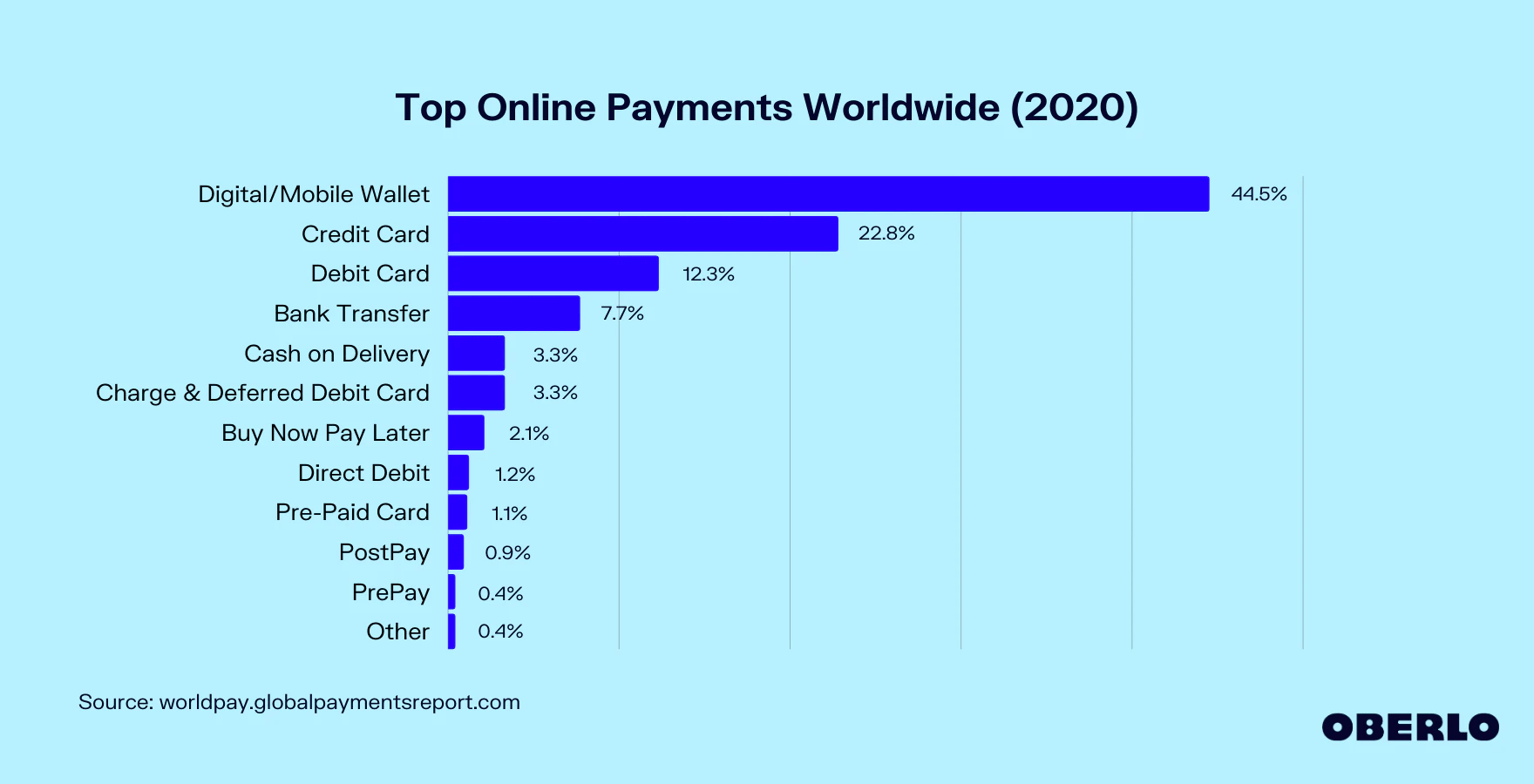

However, back to online payments. According to the 2020 report, along with e-wallets, credit and debit cards are among the most popular payment methods in the world.

Although many merchants actively use payment gateways for processing credit cards, not everyone understands what credit card processing fees are, how they are calculated, and how to minimize them. Let’s take a closer look at all these points.

The definition of credit cards processing fees

Processing is an activity that includes collecting, processing, and distributing information on transactions with bank cards to settlement participants, carried out by a processing center.

Credit Card Processing Fees: The percentage of the amount of each transaction that the payment card company charges and the payment intermediaries involved in the processing of the transaction.

In addition to the standard fees, the merchant service provider (payment processor) that processes your credit card payments also charges a small fee. Together they form the processing fee that you, as a merchant, pay when accepting credit card payments.

How to calculate credit card processing fees?

So how are seller fees calculated? Various payment processing pricing models offer business owners a variety of options. Let’s take a look at the main components of payment processing fees.

Interchange commission

The commission is charged by issuing banks for processing credit and debit card payments. The process for deducting interchange fees is simple:

- The merchant accepts payment by credit or debit card for the product or service;

- The acquiring bank transfers funds to the merchant account;

- The issuing bank withdraws funds from the client’s account, deducts the commission, and transmits the final amount to the merchant’s corporate account.

Interchange fees make up the bulk of the fees merchants pay and are charged as a percentage of each transaction, plus a small, fixed amount, roughly $ 0.2-0.5.

The following factors affect the value of the commission for an interbank exchange:

- Business type. Depending on which category your business belongs to, the commissions will differ slightly. Also, banks charge a large commission for high-risk types of business, such as gambling, forex, nutra;

- Bank card type. The size of the commission is influenced by the type of card used, credit or debit. In addition, the category of the card is also essential. Whether your card is a bonus, business, or universal;

- Payment network type. There are 4 leading credit card issuers: Visa, Mastercard, American Express, and Discover. Their commissions, albeit insignificantly, differ;

- Transaction type. Whether the customer pays online, through a POS terminal, or contactless, this is also considered when calculating fees.

Assessment fee

The appraisal fee is a tiny fixed percentage applied to the total monthly volume for a particular card type.

Payment processor commission

Payment processor fees are commissions that payment companies charge merchants for processing payments from customers.

The size of the payment processing fee depends on the pricing model preferred by the payment processor and the level of risk of the transaction.

High-risk transactions such as e-commerce transactions require higher processing fees than low-risk transactions because the risk of fraud is significantly higher.

To know more about the PayOp tariffs, please, visit the Pricing page.

What are the average credit card processing fees?

Above, we have listed the components that form the average commission on credit cards.

Now let’s compare credit card processing fees of the most popular payment systems for small businesses:

PayOp

International payment processor and official partner of Visa / Mastercard. The company provides acquiring services worldwide, except for sanctioned countries, and has more than 300 payment methods.

PayOp processing fees:

| International cards | From 2.4% + 0.2 USD fixed fee |

| Local markets | From 2.7% + 0.3 USD fixed fee |

| Alternative payment methods | From 3.0% + 0.1 USD fixed fee |

| Chargeback | From 20 USD |

| Integration | Free |

Square

Square is a mobile payments company that offers a suite of business software, POS systems, payment hardware, and credit card processing services for small businesses. The company operates in the following countries: Australia, Canada, Japan, UK, Ireland, and the USA.

Square processing fees:

| Inserted Chip Cards | 1.75% per payment |

| Contactless Cards and Devices | 1.75% per payment |

| Swiped Magnetic Stripe Cards | 1.75% per payment |

| POS App Manually Keyed-In Cards | 2.5% per payment |

| POS App Card on File Transactions | 2.5% per payment |

| Invoices | 2.5% per payment |

| Invoices Card of File Transactions | 2.5% per payment |

| Virtual Terminal | 2.5% per payment |

| Virtual Terminal Card on File Transactions | 2.5% per payment |

| Online Checkout Link Recurring Payments | 2.5% per payment |

| Square Online | 1.9% for European cards and 2.9% for non-European cards per payment |

| Square eCommerce API | 1.9% for European cards and 2.9% for non-European cards per payment |

| Square Online Checkout Links | 1.9% for European cards and 2.9% for non-European cards per payment |

| Digital Gift Cards | 1.9% for European cards and 2.9% for non-European cards per payment |

| Recorded Cash, Cheques and Other Tender | Free |

PayPal

PayPal is a company that provides services for receiving, processing, and sending funds online. Merchants can use the platform to send and receive payments internationally as part of their business. Merchant can withdraw funds to a bank account or credit/debit card, registered with the merchant’s or their company name.

PayPal processing fees:

| International cards | From 4.40% + fixed fee |

| Standard rate for receiving domestic transactions | From 3.4% + fixed fee |

| Receiving micropayments | From 5.0% + micropayments fee |

| Chargeback | From £14 |

See the full list of PayPal merchant credit card processing fees.

You can be also interested in PayPal alternatives for high-risk business in 2021.

2Checkout

2Checkout is an electronic payment service that allows merchants to accept online credit card payments from customers at home and abroad.

The company’s tariff scale is divided into 3 packages, each optimized for different needs.

2Checkout processing fees:

| 2SELL | 3.5% + $0.35 fixed fee | Easy and simple way to sell globally |

| 2SUBSCRIBE | 4.5% + $0.45 fixed fee | Develop & Boost your subscription business |

| 2MONETIZE | 6.0% + $0.60 fixed fee | All in one solution to sell DIGITAL GOODS globally |

Authorize.net

Authorize.Net is an online payment gateway that allows small and medium businesses to accept credit card payments and electronic checks from websites and automatically deposit funds into a merchant’s bank account. The company accepts credit cards, electronic checks, gift cards, and signed debit cards for payment.

Authorize.Net processing fees:

| Payment Gateway Only | All-in-One option |

| No setup fee | No setup fee |

| Monthly gateway: $25 | Monthly gateway: $25 |

| Per transaction 10¢, daily batch fee 10¢ | Per transaction 2.9% + 30¢ |

Stripe

Stripe provides a secure and scalable payment and transaction processing solution for a variety of online businesses.

Stripe processing fees:

| Credit and debit cards | 1.4%+20p for European cards |

| International payments | 2.9% + 20p for non-European cards |

| Adaptive Acceptance | 0.08% per successful card charge. |

| Local payment methods | 1% · 20p min., £2 cap |

The bottom line

Now that you know how payment processing fee is formed, we hope you choose a reliable payment service provider.

At PayOp, we value our customers, so our platform is constantly updated, improving the functionality and providing new payment solutions. If you need a reliable payment processor for your small business, create an account, go through the verification process, and start accepting payments.

Happy processing!